Mexico Smart Microgrids Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Smart Microgrids Market Size, Share, Trends and Forecast by Type, Component, Power Technology, Consumer Pattern, Application, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

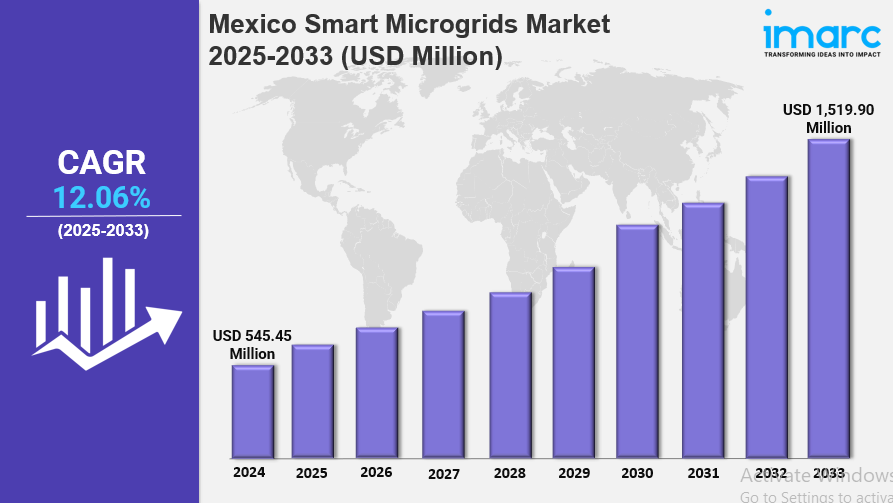

The Mexico Smart Microgrids Market reached USD 545.45 Million in 2024 and is anticipated to grow to USD 1,519.90 Million by 2033, exhibiting a CAGR of 12.06% during the forecast period 2025-2033. Growth is driven by rural electrification, renewable energy integration, supportive government policies, ESG initiatives, and advancements in IoT and software platforms. Public-private energy sector collaborations and resilience needs after natural disasters also accelerate market expansion.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

Mexico Smart Microgrids Market Key Takeaways

-

Current Market Size: USD 545.45 Million in 2024

-

CAGR: 12.06%

-

Forecast Period: 2025-2033

-

Mexico achieved 99.1% rural electrification access in 2023, boosting smart microgrid deployments.

-

Distributed generation capacity reached 3,361 MW at end-2023, with solar PV dominant.

-

Clean energy accounted for 31.2% of Mexico's power generation in 2022.

-

Government programs incentivize renewable energy adoption and energy efficiency in municipal lighting and buildings.

-

Strong public-private partnerships enhance infrastructure and investment opportunities.

Sample Request Link: https://www.imarcgroup.com/mexico-smart-microgrids-market/requestsample

Mexico Smart Microgrids Market Growth Factors

Growing Rural Electrification Initiatives

Mexico has significantly advanced rural electrification with 99.1% electricity access achieved for rural populations as of 2023. This progress is aligned with the National Power System Development Program (PRODESEN), which prioritizes infrastructure expansion to underserved areas to support social and economic development. Localized efforts in regions like Chiapas and Baja California involve deploying decentralized renewable energy systems such as solar home systems, addressing challenges in extending traditional grids to remote areas. Such initiatives provide clean and reliable electricity, fostering increased demand and deployment of smart microgrid solutions.

Integration of Renewable Energy in Distributed Networks

By the end of 2023, Mexico's distributed generation capacity grew to 3,361 MW, adding 700 MW that year primarily through solar photovoltaic installations. The country's favorable solar irradiance and decreasing solar technology costs encourage adoption by both residential and commercial consumers. Distributed generation reduces transmission losses and bolsters grid reliability while empowering consumers to become prosumers who can sell surplus power. These developments support Mexico's clean energy objectives, with clean energy sources representing 31.2% of power generation in 2022, further accelerating market growth in smart microgrids.

Supportive Government Regulations and Funding Programs

Mexico Smart Microgrids Market growth is being driven by government-led initiatives and regulatory programs aimed at promoting renewable energy adoption and energy efficiency. Key efforts, such as the National Project for Energy Efficiency in Municipal Public Lighting and incentives for sustainable, energy-efficient building designs in Mexico City, are helping reduce greenhouse gas emissions and support a cleaner energy transition. Additionally, federal subsidies and incentives for green energy companies are fostering increased investment, job creation, and technology deployment, significantly propelling the expansion of the Mexico Smart Microgrids Market.

To get more information on this market, Request Sample

Mexico Smart Microgrids Market Segmentation

Breakup By Type:

-

Hybrid: Combines different microgrid configurations for optimized performance.

-

Off-Grid: Microgrids operating independently of the main grid, ideal for remote areas.

-

Grid Connected: Microgrids integrated with the main electrical grid to enhance reliability.

Breakup By Component:

-

Storage: Energy storage systems that ensure supply continuity and load balancing.

-

Inverter: Devices converting DC to AC power, essential for microgrid operation.

Breakup By Power Technology:

-

Fuel Cell: Microgrids using fuel cell technology for efficient power generation.

-

CHP: Combined heat and power technology that produces electricity and thermal energy.

Breakup By Consumer Pattern:

-

Urban: Microgrid applications concentrated in city and metropolitan areas.

-

Rural: Microgrid deployment focused on less populated and remote regions.

Breakup By Application:

-

Campus: Smart microgrids deployed in educational and institutional campuses.

-

Commercial: Microgrids for commercial buildings and business establishments.

-

Defense: Microgrids serving defense and military facilities.

Breakup By Region:

-

Northern Mexico: Regional focus on northern states.

-

Central Mexico: Covering central Mexican regions.

-

Southern Mexico: Including southern states.

-

Others: Additional unspecified regions.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and others represent the major regional markets for smart microgrids in Mexico. The report does not specify a dominant region or provide exact market share statistics or CAGR by region. Therefore, no dominant region can be determined from the source. The analysis covers the comprehensive market scenario across all major Mexican regions, emphasizing regional deployment variations.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=34677&flag=C

Recent Developments & News

In 2024, Mexico announced a USD 23 billion investment plan aimed at enhancing electricity infrastructure, grid reliability, and promoting private sector participation. In June 2023, Iberdrola sold 55% of its Mexican power generation assets to Mexico Infrastructure Partners for USD 6 billion to focus on expanding its wind and solar energy portfolios. These initiatives indicate strong governmental and private sector momentum in electric infrastructure and renewable energy investments.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness