Mexico Carbon Capture and Storage Market 2025 Size, Share, Industry Overview and Forecast to 2033

Market Overview

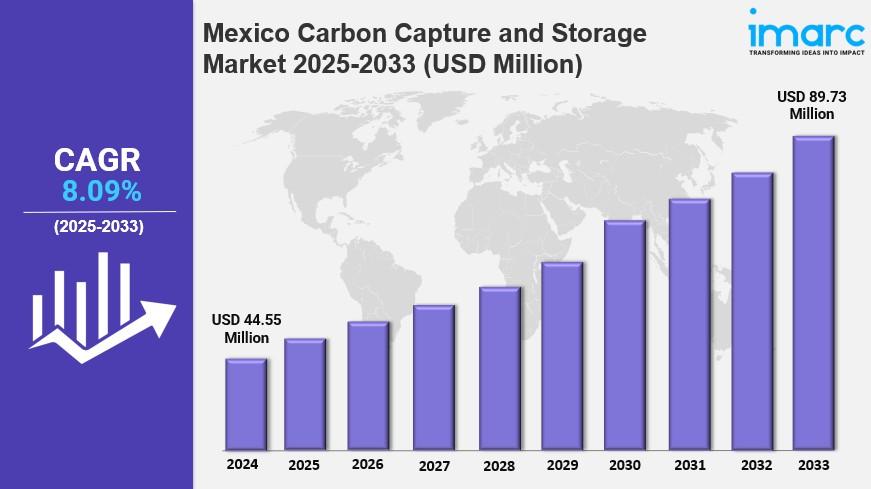

The Mexico carbon capture and storage market achieved a size of USD 44.55 Million in 2024. Forecasts indicate growth to USD 89.73 Million by 2033, with a CAGR of 8.09% between 2025 and 2033. This expansion is driven by favorable government policies, rising industrial emissions, and technological advancements improving CCS efficiency. The growing emphasis on sustainable energy under Mexico's Energy Transition Law further supports market growth.

Study Assumption Years

● Base Year: 2024

● Historical Years: 2019-2024

● Forecast Period: 2025-2033

Mexico Carbon Capture and Storage Market Key Takeaways

● Current Market Size: USD 44.55 Million in 2024

● CAGR: 8.09% from 2025 to 2033

● Forecast Period: 2025-2033

● The Mexican market is bolstered by supportive government regulations encouraging CCS adoption through tax relief, financial incentives, and regulatory frameworks.

● Industrial emissions, especially from oil and gas, manufacturing, and cement sectors, are rising, prompting greater demand for carbon management solutions.

● Technological innovations and strategic partnerships enhance CCS efficiency and cost-effectiveness, facilitating broader market penetration.

● The Energy Transition Law (LTE) mandates at least 35% of electricity from clean sources by 2024, promoting CCS and sustainability.

● North American collaboration with the U.S. and Canada aims for 50% power generation from low-carbon sources by 2025, fostering CCS deployment.

Sample Request Link: https://www.imarcgroup.com/mexico-carbon-capture-storage-market/requestsample

Market Growth Factors

The Mexico carbon capture and storage market growth is incresing mainly due to government regulations and policies intended to reduce carbon emissions. The government is encouraging the development of green infrastructure and can provide financial aid, tax relief, regulatory norms and other support mechanisms to encourage the private and public domain in the carbon capture and storage market. Mexico's participation in international climate agreements is another driver for the adoption of low-carbon technologies in the energy sector. Mexico's 2015 LTE mandated that at least 35% of the electricity consumed in Mexico be from clean energy sources starting in 2024. The legislation seeks to reduce reliance on fossil fuels and promote environment friendly technologies with the intent of creating an enabling environment for CCS applications.

Other important sectors in Mexico include oil and gas (for electricity and heating), manufacturing, and cement. All of these sectors have been growing, increasing their share of industrial GHG emissions. This makes the adoption of carbon management solutions including CCS technologies a possibility as companies become increasingly aware of their carbon footprint and search for a way to meet national and international climate obligations. With emissions continuously increasing, the demand for reliable and advanced CCS technologies will expand and is expected to drive market growth in the future as companies pursue operational and environmental goals.

Technology is among the most important driving forces of the Mexico CCS market, delivering higher efficiencies and lower costs per metric ton for carbon dioxide capture, transport and storage. Companies throughout the world and within the nation are creating alliances to use and expand advanced carbon capture and storage technologies in the nation. Improved monitoring of CO2 storage sites, along with continued development of capture technology and research and development, are contributing toward increasing commercial viability of CCS, particularly in the industrial sector where companies are seeking to reduce emissions to comply with regulations, policies, or goals. In North America, the United States, Mexico and Canada declared they would invest in CCS to reach 50 percent of power generation from renewables and low-carbon sources by 2025.

Market Segmentation

Service Insights:

● Capture: Encompasses technologies and services aimed at capturing CO2 emissions from various sources to prevent atmospheric release.

● Transportation: Involves the movement of captured CO2 to storage sites through pipelines or other means ensuring safe and efficient delivery.

● Storage: Covers the techniques and facilities for securely storing carbon dioxide underground to prevent environmental impact.

Technology Insights:

● Post-combustion Capture: Techniques that capture CO2 from flue gases after fossil fuel combustion.

● Pre-combustion Capture: Capture of CO2 before fuel combustion, typically during fuel processing.

● Oxy-fuel Combustion Capture: Involves burning fuel in oxygen instead of air, producing a concentrated CO2 stream that is easier to capture.

End Use Industry Insights:

● Oil and Gas: CCS applications targeting carbon emissions within the oil and gas extraction and processing sectors.

● Coal and Biomass Power Plant: CCS solutions implemented in coal-fired and biomass energy generation facilities.

● Iron and Steel: Technologies focused on reducing carbon emissions during metal production processes.

● Chemical: CCS applications in chemical manufacturing industries to mitigate greenhouse gases.

● Others

Regional Insights

The report categorizes the Mexican CCS market regionally into Northern Mexico, Central Mexico, Southern Mexico, and Others. While dominant regional market specifics such as share or CAGR are not explicitly provided, the segmentation indicates comprehensive coverage of all major Mexican regions, underlying the nationwide deployment of CCS technologies.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness