United States Contact Lenses Market Size, Share, Industry Overview, Growth and Forecast 2025-2033

Market Overview

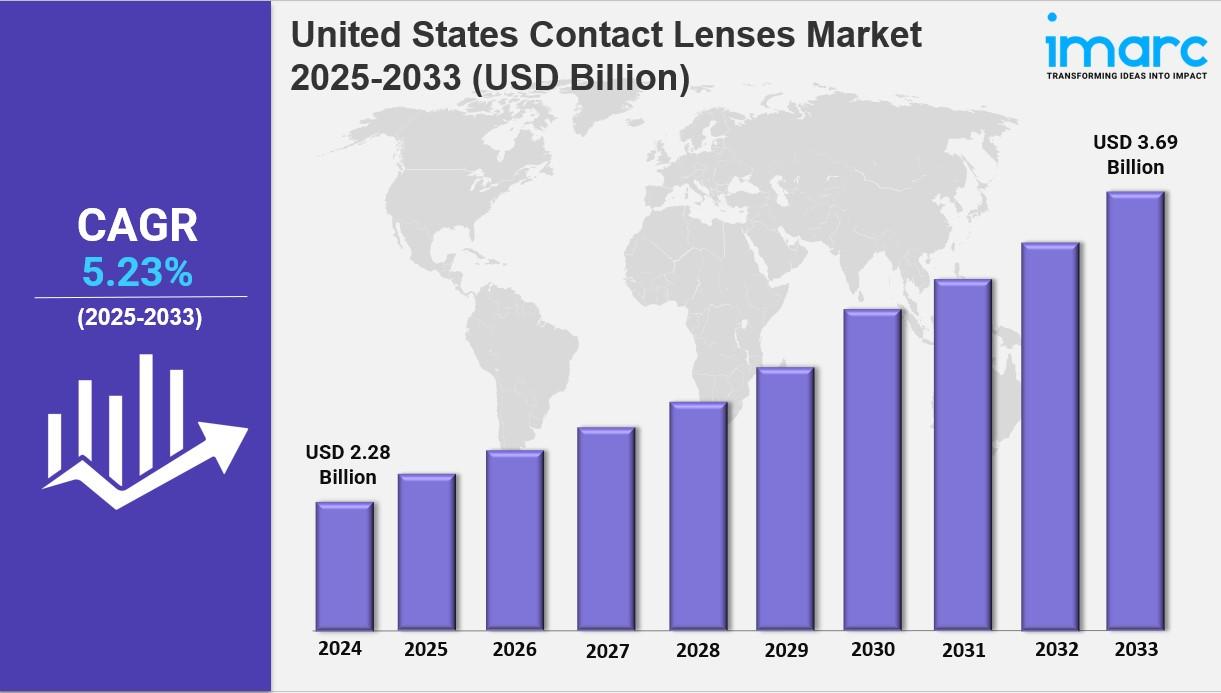

The United States contact lenses market size was valued at USD 2.28 Billion in 2024 and is expected to reach USD 3.69 Billion by 2033, growing at a CAGR of 5.23% during the forecast period 2025-2033. Growth is driven by rising vision disorders, extended screen use, advancements in lens technology, and increasing demand for disposable and daily-use lenses. Innovations like blue-light blocking and moisture-retaining lenses, alongside convenience in online shopping, further fuel market expansion.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

United States Contact Lenses Market Key Takeaways

● Current Market Size: USD 2.28 Billion in 2024

● CAGR: 5.23% (2025-2033)

● Forecast Period: 2025-2033

● Rising prevalence of vision disorders including myopia, hyperopia, and astigmatism drives demand.

● Growth supported by technological advances such as silicone hydrogel and multifocal lenses enhancing comfort and vision.

● Increasing consumer preference for disposable and daily-wear contact lenses owing to hygiene benefits.

● Expansion of online retail channels and subscription-based models boost accessibility and convenience.

● Growing interest in smart contact lenses for health monitoring and augmented reality integration.

Sample Request Link: https://www.imarcgroup.com/united-states-contact-lenses-market/requestsample

Market Growth Factors

The United States contact lenses market growth is primarily propelled by the rising incidence of vision disorders such as myopia, hyperopia, and astigmatism. Approximately 12 million individuals aged 40 and older have vision impairment in the U.S., with 1 million being blind. Astigmatism affects one in three Americans, nearsightedness affects 34 million or 23.9% of those over 40, and farsightedness affects 14.2 million or 8.4%. Extended digital device use intensifies eye strain and vision decline, pushing demand for corrective lenses higher. Technological advancements in lens materials and designs—including silicone hydrogel and multifocal lenses—are enhancing comfort and visual acuity, attracting more consumers to contact lenses.

The increasing hygiene benefits of disposable and daily-wear lenses also support market growth. These lenses minimize infection risks by reducing deposit buildup and eliminating cleaning routines, making them favored choices, particularly for those with sensitive eyes or allergies. Additionally, ongoing innovations such as blue-light blocking and moisture-retaining lens technologies heighten consumer appeal. Greater awareness of eye health and routine eye exams further elevate market demand.

The market is boosted by new consumer preferences and innovations in contact lenses. The rise in aesthetic and specialty lenses, including colored and cosmetic lenses, has grown especially among younger consumers seeking cosmetic enhancements. Orthokeratology lenses, which temporarily reshape the cornea to reduce glasses reliance, have also gained traction. Growing e-commerce and subscription-based services improve access and delivery convenience. Furthermore, investment in R&D continues introducing smart contact lenses capable of monitoring eye health and integrating augmented reality, fueling future market prospects and diversification.

Market Segmentation

Analysis by Material:

● Gas Permeable

● Rigid gas permeable lenses offer superior oxygen permeability, sharper vision correction for astigmatism and keratoconus, durable, cost-effective, and resistant to protein deposits.

● Silicone Hydrogel

● Most popular for breathability, moisture retention, and suitability for extended and daily wear; widely recommended by professionals for comfort and eye health.

● Hybrid

● Combine soft and gas permeable benefits, with rigid centers and soft outer rings; suitable for irregular corneas and post-surgical patients despite higher costs.

● Others

● Not provided in source.

Analysis by Design:

● Spherical

● Common for myopia and hyperopia; uniform curvature; available in daily, bi-weekly, monthly disposables; affordable and easy to fit.

● Toric

● Designed for astigmatism with unique orientation; available in soft and gas-permeable materials; driven by prevalence and stabilization technology.

● Multifocal

● Addresses presbyopia with multiple prescription strengths; available in soft and rigid lenses; influenced by aging population and demand for glasses alternatives.

● Others

● Not provided in source.

Analysis by Usage:

● Daily Disposable

● Single-use lenses offering maximum hygiene and convenience; favored by allergy sufferers; fastest-growing segment.

● Disposable

● Typically bi-weekly or monthly; balance cost and hygiene; popular across prescriptions; fueled by silicone hydrogel availability.

● Frequently Replacement

● Changed every 1-3 months; require cleaning; cost-effective; improved comfort due to new coatings.

● Traditional

● Extended use up to 6 months-1 year; durable; require meticulous care; for complex prescriptions; less common yet relevant.

Analysis by Application:

● Corrective

● Most widely used; correct refractive errors; include spherical, toric, multifocal; driven by rising vision impairments and tech advances.

● Therapeutic

● Medical use to protect cornea, aid healing, reduce discomfort; for corneal abrasions, dry eye, post-surgery.

● Cosmetic

● Change eye color/pattern; prescription and non-prescription; growing via social media and beauty trends.

● Prosthetic

● Customized for damaged or disfigured eyes; enhance appearance and confidence; improved realism via advanced customization.

● Lifestyle-oriented

● Provide UV protection, blue-light filtering, moisture retention; popular among digital users and outdoor enthusiasts.

Analysis by Distribution Channel:

● E-commerce

● Offers convenience, competitive pricing, wide options; subscription models and virtual try-ons boost growth.

● Eye Care Practitioners

● Trusted channel for prescriptions and fitting; critical for specialty lenses; provide patient education.

● Retail Stores

● Immediate availability; partner with brands for deals; offer eye exams and consultations; remain important despite e-commerce growth.

Regional Insights

The South region, including Texas, Florida, and Georgia, is the fastest-growing and one of the largest contact lens markets in the U.S. Demand is driven by the need for breathable and moisture-retaining lenses, influenced by the warm climate and active lifestyles. Urbanization, aging demographics, and increasing awareness about vision correction contribute to growth. The prominence of retail chains and e-commerce further enhances access and accelerates market expansion in the South.

Recent Developments & News

On October 14, 2024, private equity groups Blackstone and TPG announced plans to partner on a bid for Bausch + Lomb, valued at over USD13 Billion, potentially the largest private equity buyout of 2024. Bausch + Lomb's share price rose 10% amid sale talks. On September 26, 2024, ZEISS Medical Technology launched the FDA-approved MICOR® 700 lens removal device in the U.S., improving cataract surgery safety and efficiency. On July 17, 2024, EssilorLuxottica acquired streetwear label Supreme for USD 1.5 billion, expanding its lifestyle portfolio. On June 24, 2024, Johnson & Johnson, with Lions Clubs International Foundation, provided eye care to over 50 million students globally under the Sight For Kids program.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20461&flag=C

Key Players

● Alcon Vision LLC

● Bausch Health Companies Inc.

● Essilor International SA

● Hoya Corporation

● Johnson & Johnson Vision Care Inc.

● Menicon Co., Ltd.

● SynergEyes Inc.

● The Cooper Companies

● Zeiss Group

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness