Patrocinados

Global Blood Warmer Devices Market Report Industry Analysis & Future Prospects

Blood Warmer Devices are Specialized Medical systems designed to heat blood and intravenous (IV) fluids to near body temperature before infusion, thereby reducing the risk of hypothermia, coagulopathy, and other complications during transfusions, surgeries, trauma care, and emergency medicine. Their importance rises in settings with high transfusion volumes, cold climates, long transport times, or in operations requiring rapid fluid administration. As healthcare facilities pursue higher standards of patient safety, blood warmers have become a standard in operating rooms, intensive care units, and emergency medical services.

Download Exclusive Sample Report: https://www.datamintelligence.com/download-sample/blood-warmer-devices-market?jk

According to DataM Intelligence, the global blood warmer devices market was valued at approximately US$ 1.38 billion in 2024, and is projected to reach US$ 12.11 billion by 2033, reflecting a very strong compound annual growth rate (CAGR) of 24.2% over the forecast period. (DataM Intelligence) This aggressive growth projection underscores how rapidly hospitals, ambulatory care centers, and emergency systems are adopting more advanced, safer, and often portable warming systems. Among the various product types, intravenous warming systems are anticipated to remain the leading segment, given their critical role in fluid transfusion settings. Regionally, North America is the dominant market, benefiting from advanced healthcare infrastructure, higher surgical volumes, and favorable reimbursement policies.

Market Segmentation

The blood warmer devices market can be segmented across product types, application or end-user groups, and device characteristics.

By Product Type

-

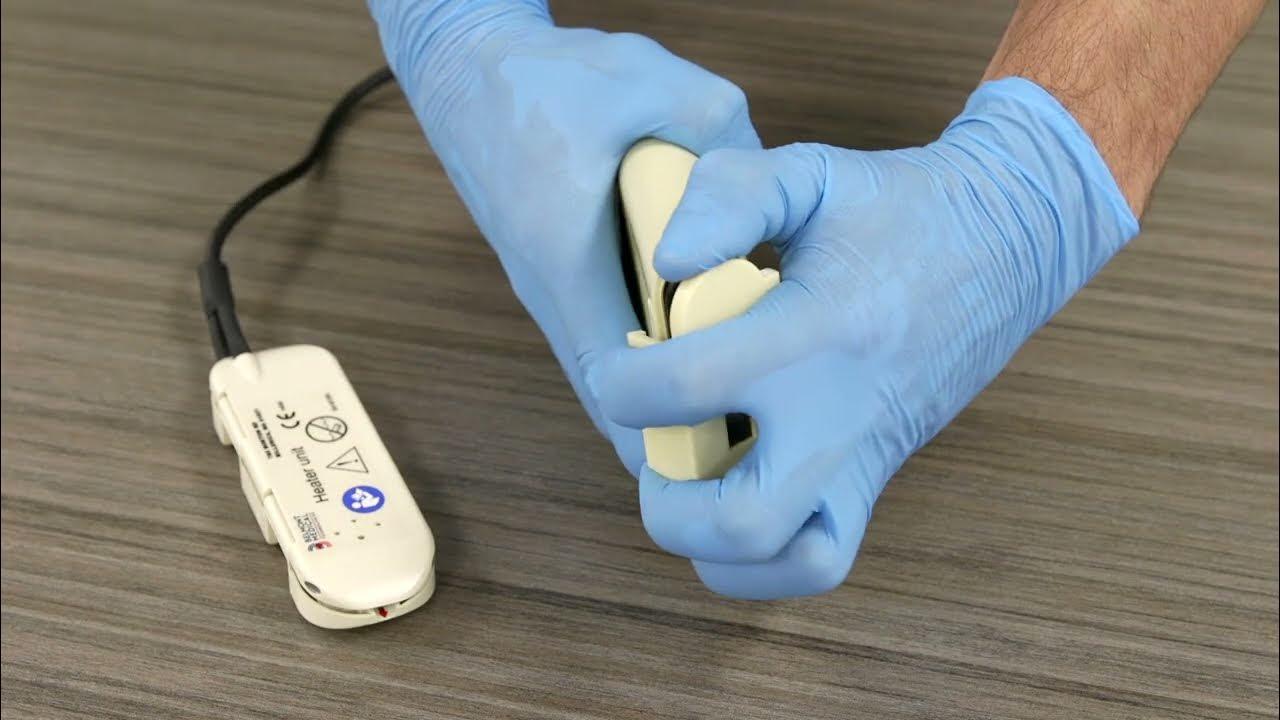

Intravenous warming systems: These are devices that warm blood or fluids inline before infusion into the patient. They are perhaps the most critical, because they directly influence core body temperature during transfusion.

-

Surface warming systems (or external warming): Though technically more associated with warming the patient, some systems include warming of tubing or reservoirs to avoid heat loss. In certain hospital systems, warming trays or carriers may fall under this bracket.

-

Accessories and consumables: Includes warming cartridges, tubing sets, extension lines, temperature probes, and warming cassettes that support the main devices.

By Application / End-User

-

Hospitals & Surgical Centers: The largest segment, where blood warmers are used in operating theaters, ICUs, and transfusion units.

-

Emergency Medical Services / Ambulance & Field Use: Portable warmers used in ambulances, helicopters, or field hospitals for trauma or mass casualty events.

-

Blood Banks / Transfusion Centers: Used to warm stored units or during large transfusion operations.

-

Other Use Cases: Military medicine, disaster relief deployments, remote clinics, and trauma centers.

By Device Characteristic / Modality

-

Portable / Mobile units: Lightweight, compact, battery-powered or plug-in devices designed for transport and use outside traditional hospital settings.

-

Stationary / fixed units: Installed devices in hospital suites, integrated with existing infusion or transfusion infrastructure.

-

Manual vs Automatic control: Some devices operate on preset temperature controls; more advanced ones include feedback sensors, alarms, and adaptive control loops.

-

Throughput / flow rate tiers: Devices rated by how many milliliters per minute (mL/min) they can warm effectively, influencing their suitability for surgical vs small-volume transfusion use.

This segmentation helps stakeholders understand where margins, adoption pressures, technical demands, and growth potential lie.

Recent Developments

-

A prominent market announcement from DataM Intelligence revealed that the blood warmer devices market, already valued at US$ 1.38 billion in 2024, is projected to expand dramatically to about US$ 12.11 billion by 2033. This highlights significant investor confidence in scalable next-generation warming technologies.

-

In parallel, market reports from other research firms suggest more conservative growth trajectories; for instance, some sources estimate a CAGR of 7-8% in the global blood warming / fluid warming market over the coming decade.

-

Several medical device companies are releasing portable, battery-powered warmers with built-in temperature safety features, wireless monitoring capabilities, and modular cartridges to tailor warming to specific flow rates.

-

Integration with hospital information systems and infusion pumps is becoming more common, allowing for smarter, safer fluid warming linked with alerts and failsafes.

-

Some players are conducting partnerships with trauma centers and field medicine programs to validate devices in harsh or mobile environments, thereby extending their use beyond the hospital.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=blood-warmer-devices-market

Revenue Insights

Revenue trends in the blood warmer devices market vary widely based on region, device type, and application. High-end intravenous warming systems command premium prices due to their precision, safety certifications, and throughput capacity. Consumables and accessory segments provide recurring revenue opportunities, though margins are lower. Portable devices, though smaller in scale, often fetch higher per-unit prices because of the engineering required for compactness, power management, and reliability.

In mature markets particularly North America and Western Europe hospital procurement cycles, capital budgeting, and regulatory approval pathways mean that revenue growth is steady but incremental. In contrast, emerging markets may see more volatility but also potential for leapfrogging older device generations. Field or EMS deployments often involve bundled service or maintenance contracts, contributing to aftermarket and service revenue streams.

One revenue insight to watch is the shift from device sale models to payment-for-use or device-as-a-service models. Some healthcare systems may favor leasing or contract models rather than outright purchases, especially for units with high initial costs. This transformation can stabilize cash flow for vendors and reduce financial burden for buyers.

Regional Insights

North America stands as a dominant region in this market. The U.S. leads by virtue of high per capita healthcare investment, significant numbers of surgeries and transfusions, strong regulatory frameworks ensuring patient safety, and early adoption of advanced medical devices. Canada also contributes, especially in large hospital systems and trauma networks.

Europe shows steady demand, especially in Western Europe, where standard-of-care protocols emphasize temperature management during transfusions and surgery. In Eastern Europe, growth is slower but present as healthcare systems modernize.

Asia-Pacific is often cited as the fastest-growing region in forecasts, driven by rising healthcare investment, increasing surgical volumes, and improving access in countries like China and India. Latin America and Middle East & Africa present pockets of demand, especially where trauma, emergencies, or military medicine applications exist.

North America’s dominance is reinforced by larger budgets, mature hospital infrastructure, strong sales and distribution networks, and high regulatory standards that drive demand for certified, reliable blood warming devices.

Global Market 2025

By mid-decade, the market is expected to become more diversified. The percentage of global market share held by portable and EMS-oriented devices is expected to increase. Emerging economies will contribute more to incremental volume, pushing vendors to offer lower-cost variants and regionally optimized devices. Standardization, cross-certification, and regulatory harmonization will help multi-national companies scale faster. More players beyond the traditional incumbents may enter niche segments (e.g. battlefield medicine, mobile clinics) and create device ecosystems (device + consumables + software). The growth rate is expected to moderate in mature markets but stay strong globally thanks to unmet needs in trauma care, dialysis, maternity, and surgical systems.

One interesting shift by 2025+ will be increased demand for smart blood warmers: devices with temperature logging, predictive maintenance, IoT connectivity, usage analytics, and integration with hospital electronic medical records. These differentiators will likely command premium pricing and help vendors build stickiness with hospitals.

Get Customized Report as per your Business Requirements: https://www.datamintelligence.com/customize/blood-warmer-devices-market?jk

Competitive Landscape

The competitive space in blood warmer devices includes established medical device firms as well as specialized niche manufacturers. Key competitive dynamics include product differentiation (speed, accuracy, safety, size), regulatory certifications (FDA, CE mark), cost of consumables, service capabilities, and customer relationships in hospitals and EMS organizations.

Major companies in the ecosystem include 3M, Stryker, GE Healthcare, Smiths Medical, Belmont Medical Technologies, ICU Medical, and others. Some focus on high-end surgical systems in large hospitals, while others target portable or EMS markets. Companies are increasingly pursuing R&D, partnerships, product upgrades, and geographical expansion.

To stay competitive, firms must invest in miniaturization, efficient heating technologies, safety features (over-temperature, alarms), integration capabilities, consumables cost management, and regulatory compliance. Aftermarket support, maintenance contracts, and consumable sales are also critical for long-term revenue and customer retention.

Strategic Outlook

From a strategic point of view, success in the blood warmer devices market will depend on a few key vectors:

-

Innovation and differentiation: Vendors must push for safer, faster, more compact, energy-efficient, and connected devices. Smart capabilities and remote diagnostics may become must-haves.

-

Scalable business models: Beyond selling devices, offering service contracts, maintenance, leasing, and device-as-a-service may unlock new revenue paths and lower buyer resistance.

-

Global expansion with localization: Tapping into emerging markets will require cost-engineered models, local regulatory navigation, and distribution networks.

-

Focus on consumables and support: Recurring revenue from tubing, probes, cartridges, calibration, servicing will sustain margins.

-

Partnerships and integration: Aligning with infusion pump vendors, hospital IT systems, EMS agencies, defense medical units, and trauma networks can broaden reach and embed devices into care workflows.

-

Regulatory & safety emphasis: Given the patient-critical nature, safety, certification, clinical validation, and post-market monitoring will be fundamental for differentiating trust.

-

Addressing underserved settings: Devices tailored for resource limited hospitals, rural clinics, mobile health units are a promising frontier.

Conclusion

The blood warmer devices market stands at an inflection point. While historically rooted in hospital-based surgical and transfusion settings, the expanding needs of trauma care, EMS, disaster relief, and remote medicine are pushing it into new frontiers. However, more conservative forecasts from other analysts temper expectations yet all agree the market is growing, innovation-driven, and ripe for disruption.