Canada Digital Wallet Market Size, Share, Industry Trends, Growth Factors and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Canada Digital Wallet Market Report by Type (Proximity, Remote), Deployment Type (On-Premises, Cloud), Industry Vertical (Education, Gaming, Information Technology and Telecommunications, Aerospace and Defense, Legal, Media and Entertainment, Automotive, Banking Financial Services and Insurance, Consumer Goods, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Canada Digital Wallet Market Overview

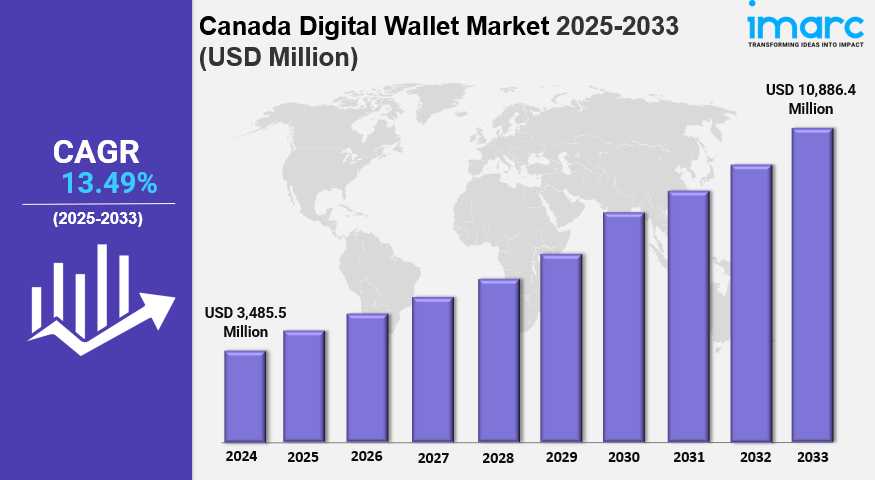

The Canada digital wallet market size reached USD 3,485.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,886.4 Million by 2033, exhibiting a growth rate (CAGR) of 13.49% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 3,485.5 Million

Market Forecast in 2033: USD 10,886.4 Million

Market Growth Rate (2025-2033): 13%.9

Request for a sample copy of the report: https://www.imarcgroup.com/canada-digital-wallet-market/requestsample

Key Market Highlights:

✔️ Strong growth driven by rising smartphone penetration and internet connectivity

✔️ Increasing adoption of contactless payments across retail and service sectors

✔️ Growing preference for secure and convenient cashless transactions

✔️ Expansion of fintech solutions and integration of loyalty & rewards programs

✔️ Rising government and bank initiatives promoting digital payment ecosystems

Trends in the Canada Digital Wallet Market

The Canada digital wallet market is set to experience several key trends that will influence its development in the coming years. One significant trend is the increasing integration of artificial intelligence (AI) to enhance user experience and streamline payment processes. By 2025, digital wallets are expected to leverage AI technologies for personalized recommendations, fraud detection, and customer support, making transactions more efficient and secure.

Additionally, the rise of cryptocurrency payments is becoming a notable trend, as more digital wallets begin to support various cryptocurrencies, catering to a growing segment of tech-savvy consumers. This shift will not only diversify payment options but also attract new users interested in digital currencies.

Furthermore, the emphasis on cross-border payment capabilities will drive innovation in the Canada digital wallet market, allowing users to make international transactions seamlessly. As these trends unfold, the Canada digital wallet market share is anticipated to grow, reflecting the increasing reliance on digital payment solutions among Canadian consumers.

Market Dynamics of the Canada Digital Wallet Market

Growing Adoption of Contactless Payments

The Canada digital wallet market is witnessing significant growth driven by the increasing adoption of contactless payment methods. With the rise of mobile payment technologies, consumers are increasingly favoring digital wallets for their convenience and speed. The COVID-19 pandemic accelerated this trend as more people sought hygienic payment options that minimize physical contact. By 2025, it is expected that the demand for digital wallets will continue to rise, with more retailers and service providers accepting mobile payments. This shift not only enhances the user experience but also encourages consumer loyalty to brands that offer seamless payment solutions.

As a result, the Canada digital wallet market size is projected to expand, with a growing number of consumers integrating digital wallets into their daily transactions. This trend is further supported by advancements in smartphone technology, which facilitate easy access to digital wallet applications, making them an integral part of the consumer payment landscape.

Increased Focus on Security and Fraud Prevention

Security remains a critical concern in the Canada digital wallet market, prompting providers to enhance their security measures to build consumer trust. As digital transactions become more prevalent, the risk of fraud and data breaches also increases, leading consumers to seek solutions that prioritize their financial safety. By 2025, it is anticipated that digital wallet providers will implement advanced security features, such as biometric authentication, tokenization, and end-to-end encryption, to protect user data. These measures are essential for not only safeguarding transactions but also for ensuring compliance with regulatory standards. As consumers become more aware of security issues, their preference for secure digital wallets will drive the market's growth.

Consequently, the Canada digital wallet market share is expected to increase as companies that prioritize security gain a competitive advantage, attracting more users who value safety in their financial transactions.

Integration of Loyalty Programs and Rewards

Another dynamic shaping the Canada digital wallet market is the integration of loyalty programs and rewards systems within digital wallet applications. As consumers seek added value from their payment methods, many digital wallet providers are partnering with retailers and brands to offer exclusive discounts, cashback, and loyalty points. By 2025, it is projected that the demand for digital wallets that incorporate these features will grow significantly, as consumers look for ways to maximize their spending benefits. This trend not only enhances customer engagement but also encourages repeat usage of digital wallets for everyday purchases. By leveraging data analytics, providers can personalize offers based on user behavior, further driving customer loyalty.

As a result, the Canada digital wallet market size is likely to expand, with a broader range of features that cater to the evolving preferences of consumers seeking convenience and rewards in their financial transactions.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=23952&flag=C

Canada Digital Wallet Market Segmentation:

Type Insights:

- Proximity

- Remote

Deployment Type Insights:

- On-Premises

- Cloud

Industry Vertical Insights:

- Education

- Gaming

- Information Technology and Telecommunications

- Aerospace and Defense

- Legal

- Media and Entertainment

- Automotive

- Banking Financial Services and Insurance

- Consumer Goods

- Others

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness