Implantable Collamer Lens Market Products Gaining Traction for Preserving Natural Lens and Depth Perception.

The global Implantable Collamer Lens Market was valued at approximately USD 334 million in 2023 and is projected to reach around USD 810 million by 2031, with a compound annual growth rate (CAGR) of 13.5% during the forecast period 2024-2031, according to DataM Intelligence.

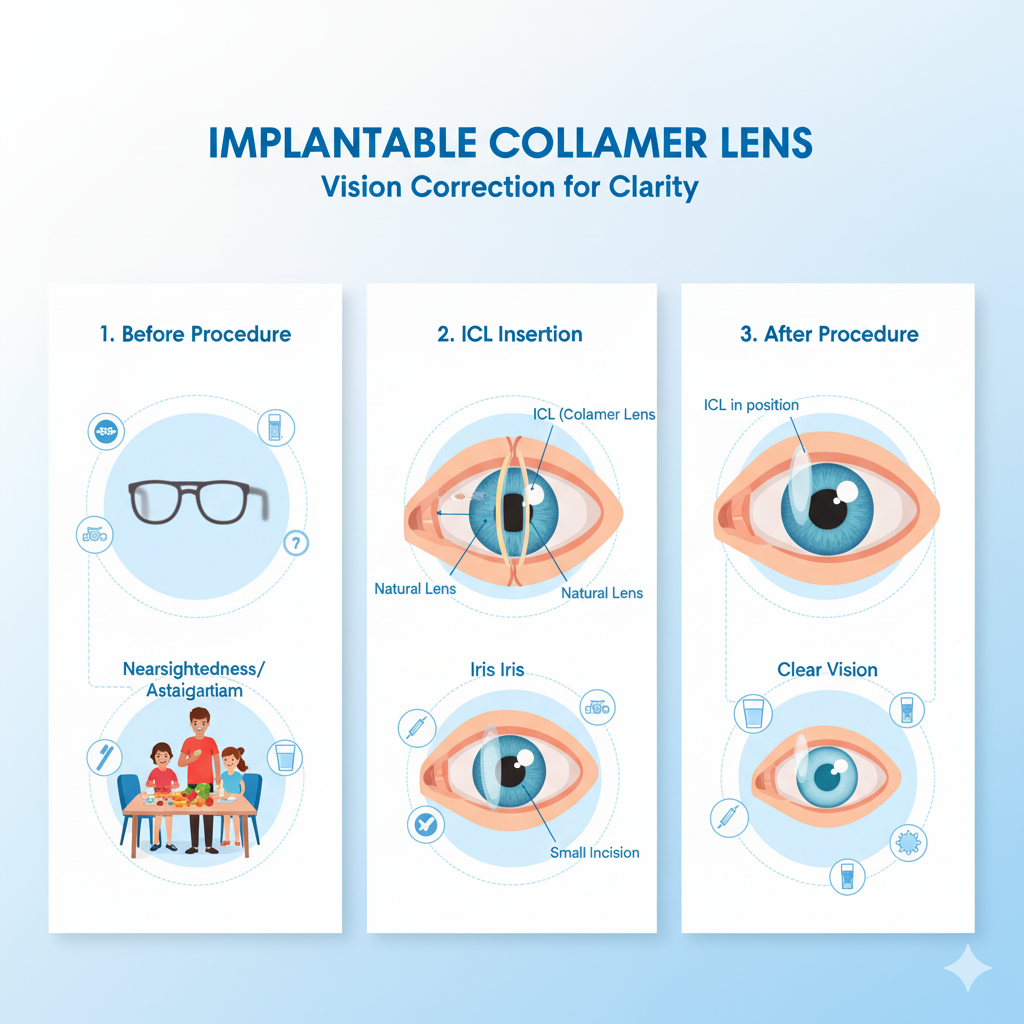

Implantable Collamer Lenses (ICLs) are intraocular lenses surgically implanted inside the eye to correct refractive errors like high myopia, hyperopia, and astigmatism, particularly for patients unsuitable for laser surgery. They offer high-quality vision correction while preserving the eye's natural lens, maintaining depth perception and low-light performance, making them ideal for activities like night driving.

For a detailed sample PDF brochure of the report, use a corporate email ID for a quick response: Download Sample PDF.

https://www.datamintelligence.com/download-sample/implantable-collamer-lens-market?sindhuri

Market Segmentation

By Type

The market is segmented into posterior chamber phakic lenses and anterior chamber phakic lenses. Posterior chamber lenses (e.g., Implantable Collamer Lenses, ICLs) dominate the market due to their placement between the iris and natural lens, which offers excellent biocompatibility, minimal disruption to corneal endothelial cells, and superior visual outcomes for a wide range of refractive errors. They are particularly favored for high myopia and astigmatism. Anterior chamber lenses are less common and are typically reserved for cases where posterior chamber implantation is not suitable. While they provide an alternative, their use is limited due to higher risks of complications such as corneal endothelial damage, iris trauma, and glaucoma.

By Application

Key applications include high myopia, refractive surgery enhancements, myopic astigmatism, and others (e.g., hyperopia, presbyopia). High myopia is the largest application segment, as ICLs provide a safe and effective solution for patients with severe nearsightedness who are not candidates for laser-based procedures like LASIK. Refractive surgery enhancements address residual refractive errors or complications from previous surgeries, offering a reversible and adjustable option. Myopic astigmatism is a growing segment with the availability of toric ICL models that correct both myopia and astigmatism simultaneously. Other applications, though smaller, are expanding as technology evolves.

By End-User

Ophthalmic clinics are the leading end-users, specializing in refractive surgeries and offering state-of-the-art ICL procedures with personalized patient care. Hospitals handle more complex cases, often involving patients with additional ocular or systemic conditions, and benefit from comprehensive medical support. Ambulatory surgical centers (ASCs) are increasingly popular due to their efficiency, lower costs, and convenience for outpatient procedures. Other end-users include academic research institutions and specialized eye care centers that contribute to clinical advancements and surgeon training. The trend toward minimally invasive, outpatient settings is driving growth in clinics and ASCs.

Market Share

North America holds the largest market share, approximately 42.4% in 2022, driven by key players, rising myopia and hyperopia cases, high adoption of vision correction surgeries, and an aging population projected to double to 95 million by 2060. Asia-Pacific is expected to witness the fastest growth due to increasing refractive error prevalence, expanding healthcare infrastructure, and growing awareness of advanced vision correction options.

Market Drivers

The market is propelled by the rising prevalence of refractive errors, with hyperopia affecting around 10% (14 million people) in the US and increasing with age, alongside myopia as the most common visual impairment globally. ICLs provide a permanent, minimally invasive alternative to glasses or contacts, boosted by product approvals like STAAR Surgical's EVO lens. However, high procedure costs ranging from USD 3,500 to 5,000 per eye, including surgery and care may restrain accessibility, particularly for those with limited resources.

Key Players

Prominent companies in the implantable collamer lens market include:

-

STAAR Surgical Company

-

Zeiss Meditec

-

Rayner Intraocular Lenses Limited

-

Care Group

-

Price Vision Group

-

Lense Home

-

Beye, LLC

Recent Developments

-

On March 28, 2022, STAAR Surgical Company announced FDA approval for the EVO/EVO+ Visian Implantable Collamer Lens for correcting myopia and myopic astigmatism, targeting up to 100 million eligible patients aged 21-45 in the US, implanted in the posterior chamber.

Conclusion

The implantable collamer lens market is poised for strong growth, driven by escalating refractive error prevalence, technological advancements in minimally invasive procedures, and an aging global population. North America's established infrastructure leads the market, while Asia-Pacific's rapid expansion highlights untapped potential. Despite cost barriers, regulatory approvals and awareness campaigns will enhance adoption, positioning ICLs as a key solution for long-term vision correction through 2031 and beyond.

About DataM Intelligence

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We leverage our top trademark trends, insights, and developments to provide swift and astute solutions to clients. Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains, creating business solutions for more than 200+ companies across 50+ countries, catering to the key business research needs that influence the growth trajectory of our vast clientele.

Contact Us

Company Name: DataM Intelligence 4Market Research LLP

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness