Patrocinados

The Essential Guide to a No Tax Return Mortgage in 2025

Many creditworthy Americans still miss out on homeownership because traditional underwriting leans heavily on W‑2s and IRS transcripts. A no tax return mortgage offers a modern path forward. This loan type verifies the borrower’s ability to repay through alternative documentation instead of tax returns. With the right lender, borrowers can document income with bank statements, asset balances, or property cash flow, and still achieve competitive terms. This guide explains how a no tax return mortgage works, who benefits, how to qualify, and how to compare options in the current market.

What Is a No Tax Return Mortgage?

A no tax return mortgage is a non-QM (non–Qualified Mortgage) product that does not require personal or business tax returns to calculate income. Lenders assess repayment capacity using other verified sources, such as:

- 12–24 months of personal or business bank statements

- CPA-prepared profit-and-loss statements

- Asset depletion or asset utilization (converting liquid assets into qualifying income)

- Rental income and debt-service coverage ratio (DSCR) for investment properties

- Employment contracts or 1099s supported by deposit histories

Importantly, modern no tax return mortgage loans still comply with federal Ability-to-Repay rules. Lenders verify income through documentation, just not through tax returns. This distinguishes today’s programs from the “stated income” era of the past.

Who Benefits Most

A no tax return mortgage can help many well-qualified borrowers whose tax filings do not reflect their true cash flow. Typical beneficiaries include:

- Self-employed owners and freelancers whose write-offs lower taxable income

- Commission-based professionals and gig-economy earners with variable deposits

- Real estate investors purchasing or refinancing rental properties

- Newly self-employed borrowers without two full years of returns

- High-asset households seeking asset depletion financing

- Retirees drawing from investment accounts instead of wages

- Foreign nationals with limited U.S. tax history

For these borrowers, mortgage without tax returns underwriting can better align with actual income patterns, making home loans without tax returns a practical solution.

Key Features and Terms

While every lender differs, many no tax return loans share these traits:

- Documentation: 12–24 months of bank statements, P&L statements, or asset statements

- Down Payment: Often 10%–25% depending on credit and property type

- Credit Score: Competitive pricing typically begins around 680–700+, with options below

- Loan Amounts: Conforming and jumbo sizes are available

- Rates: Generally higher than standard agency loans due to risk and manual underwriting

- Reserves: Two to twelve months of payment reserves may be required

- Property Types: Primary, second homes, and investment properties, including DSCR loans

Borrowers should expect thoughtful documentation and a common-sense analysis of cash flow, not a no-doc approach. Get started with your application online and free.

How Lenders Calculate Income Without Tax Returns

Lenders use transparent formulas. Examples include:

- Bank Statement Method: Average eligible deposits over 12–24 months, apply an expense factor (varies by industry or CPA letter), and annualize the result.

- Asset Depletion: Divide qualified liquid assets by a set period (often 84–360 months) to produce monthly qualifying income.

- DSCR for Investors: Compare property rents to housing expenses. Many lenders approve when DSCR ≥ 1.0, with stronger pricing when DSCR ≥ 1.25.

This methodology allows a mortgage without tax returns to align underwriting with real cash flow, especially for business owners.

Pros and Cons

Advantages:

- Uses real deposits instead of tax-adjusted income

- Offers flexibility for variable or seasonal earners

- Enables investors to qualify by property cash flow

- Expands access to financing when traditional routes fall short

Trade-offs:

- Interest rates and fees can be higher than agency loans

- Larger down payments and reserves are common

- Documentation still requires organization and transparency

- Not all lenders offer every variant; shopping matters

Comparing Similar Terms and Products

The market uses overlapping terms. Here is how they typically differ:

- No tax return mortgage: Umbrella term for mortgages using alternative income documentation.

- No tax return mortgage loans: Same concept, often emphasizing bank statement or asset-based options.

- Home loans without tax returns: A borrower-facing phrase describing the same category.

- Mortgage without tax returns: An alternative phrasing used by lenders and media.

- No tax return loans: A broader label that can include mortgages and other lending.

- Personal loan no tax return: Usually an unsecured installment loan with higher rates and lower limits; not a mortgage substitute for home purchases.

For home purchases and refinances, borrowers generally focus on bank statement mortgages, asset depletion loans, or DSCR loans rather than a personal loan no tax return.

Eligibility Checklist

Strong candidates for a no tax return mortgage often have:

- Consistent bank deposits over 12–24 months

- 680+ credit, with compensating factors for lower scores

- Clean housing history and minimal serious delinquencies

- Sufficient down payment and cash reserves

- Clear business documentation when self-employed

A well-prepared file reduces surprises and speeds up approval.

Step-by-Step Application Path

- Pre-Assessment: A loan specialist reviews goals, property type, and documentation options. Early rate and payment estimates help set expectations.

- Document Strategy: Borrowers choose bank statements, asset depletion, DSCR, or a combination. Lenders request statements, ID, corporate docs, and credit authorization.

- Pre-Approval: Underwriters analyze deposits, apply expense factors, and issue a pre-approval with conditions. Get prequalified Now!

- Property and Appraisal: The appraisal confirms value and, for DSCR, market rent. Title and insurance are ordered.

- Final Conditions: The borrower uploads any remaining verifications. The lender clears conditions and prepares closing.

- Closing: The borrower reviews disclosures, funds the down payment, and signs loan documents.

Cost-Saving Tips

- Shop multiple lenders that specialize in no tax return mortgage loans and compare annual percentage rates, not just note rates.

- Ask about lender credits and discount points; evaluate total five-year cost, not only monthly payment.

- Keep personal and business deposits clean; avoid large unexplained transfers.

- Build reserves before applying; extra liquidity can improve terms.

- For investors, improve DSCR with modest rent increases or reduced expenses before application.

Compliance, Fairness, and 2025 Best Practices

Responsible lenders follow Ability-to-Repay rules and avoid steering. In 2025, transparent underwriting, clear disclosures, and verifiable documentation align with Google’s emphasis on helpful, credible content and the industry’s focus on borrower outcomes. Borrowers benefit from lenders that explain methods, provide scenario comparisons, and ensure the loan fits the borrower’s goals and risk tolerance.

Frequently Asked Questions

- Are tax returns ever requested? In true no tax return mortgage programs, lenders do not use tax returns for income calculation. However, they may still verify identity, assets, and credit.

- Do these loans work for first-time buyers? Yes, if the borrower meets credit, down payment, and documentation guidelines.

- Can investors qualify with negative tax returns? Yes. DSCR loans qualify based on property cash flow rather than personal returns.

- How fast can these loans close? Many close in 21–35 days when documentation is complete.

- Are rates fixed or adjustable? Both are available. Fixed rates provide payment stability; ARMs can offer lower initial rates.

Use Cases That Make Sense

- A consultant with large business write-offs demonstrates strong deposits on 24 months of business bank statements and secures competitive terms.

- A retiree with substantial liquid assets qualifies using asset depletion on a second home.

- An investor purchases a duplex with a DSCR of 1.20 and locks a rate aligned with rental income.

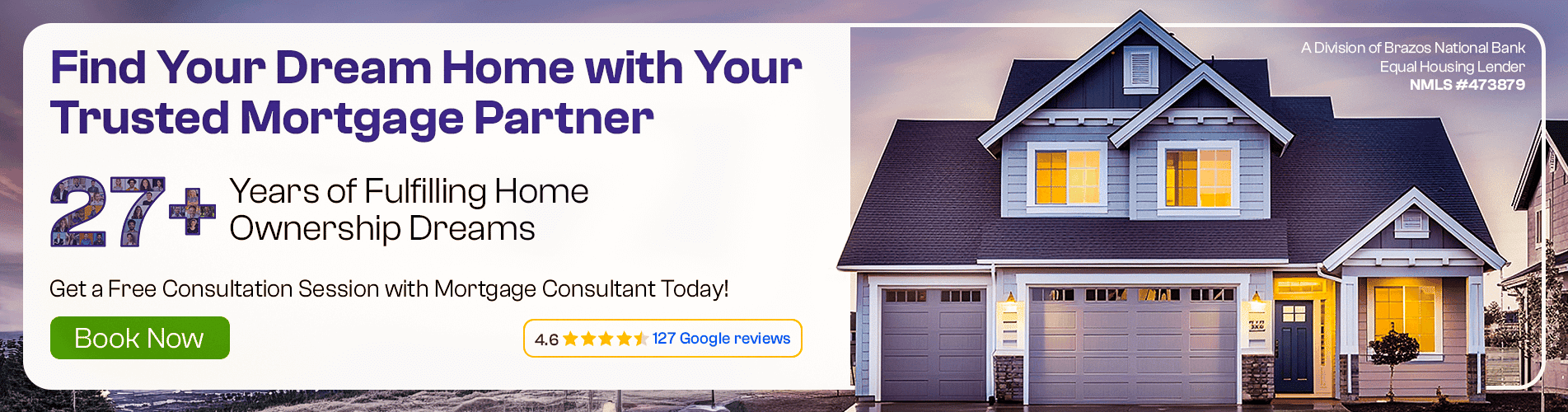

Partner Spotlight

Dream Home Mortgage stands out as a reliable, nationwide lender in the mortgage industry in the USA. The company offers comprehensive services that cover all aspects of a no tax return mortgage from pre-qualification to closing.

Getting Started

Success with a no tax return mortgage begins with clarity. Borrowers who map out their income documentation strategy, organize statements, and partner with an experienced non-QM lender often discover options that traditional channels overlook. In a market where self-employment and diversified income streams are the norm, home loans without tax returns provide a practical, responsible, and increasingly mainstream path to ownership and investment.

Bottom Line

A no tax return mortgage can transform strong cash flow into mortgage approval without relying on tax returns. With the right program—bank statements, asset depletion, or DSCR—qualified borrowers can unlock financing that fits their real financial picture. Comparing lenders, understanding terms, and preparing documentation are the keys. For many in 2025, this approach is not only possible; it is often the most accurate way to capture income and build wealth through real estate.