Mexico Private Equity Market Size, Growth & Research Report (2025-2033) | UnivDatos

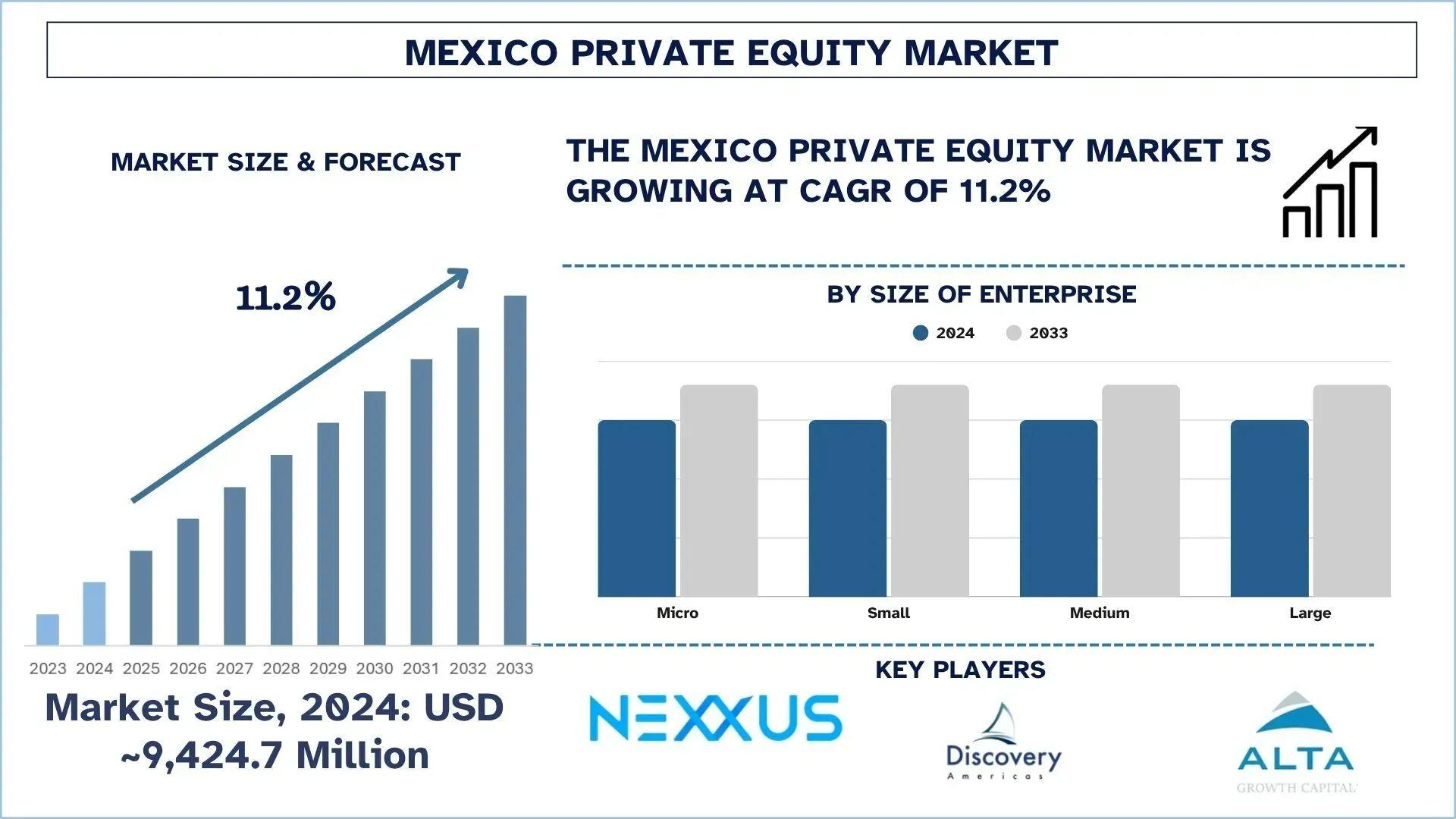

According to the UnivDatos, Mexico’s strategic nearshoring potential, attracting investment in manufacturing, logistics, and mid-market enterprises, would drive the Mexico Private Equity market. As per their “Mexico Private Equity Market” report, the market was valued at USD 9,424.7 Million in 2024, growing at a CAGR of about 11.2% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The Mexican private equity (PE) market forms an important part of the Latin American investment ecosystem; it has a strong mix of local and international investment potential to offer to investors. The market mainly consists of investments in non-publicly traded companies in sectors, which include industrial manufacturing, logistics, fintech, healthcare, real estate, and consumer goods. The PE firms located in Mexico usually work on buyouts, growth equity, venture capital, and private credit transactions. The market is maturing gradually, and this has been enabled by, among other things, the economic diversification of the country, the young, expanding population, and the evolution of the local institutional investors, including pension funds (AFORES).

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/mexico-private-equity-market?popup=report-enquiry

The Growing Demand for Mexico Private Equity

The combination of strategic geographic privileges, macroeconomic stability, and the revolutionization of an industry is distinctly making a couple of synergies in supporting the surging demand for the endowment of private equity in Mexico. As companies worldwide are reviewing their supply chain, there is no doubt that Mexico is located near the US, which, in addition to offering favorable trade conditions through USMCA, is adding to it an attractive investment decision, particularly in manufacturing, logistical, and infrastructure sectors. Meanwhile, start-up boom and increasing digitalisation are drawing attention to high-growth stocks under fintech, e-commerce, and enterprise technologies, and the deal flow is also an upward trend, thanks to rising formalisation and regulatory reshaping, as medium-sized companies that need capital to expand their operations are added to the list with increasing funds required. The trends are aiding the establishment of a robust and varied investment climate that continues to attract both domestic and foreign-based private equity players.

Latest Trends in the Mexico Private Equity Market

The Mexico Private Equity market is witnessing several emerging trends. Here are some of the key trends shaping the market

Nearshoring Recalibration

Nearshoring has always been the major strategic determinant when investing in Mexico through private equity, but current events have brought some caution. On the one hand, manufacturers and players in the field of logistics continue to find it very attractive to move supply chains closer to the U.S., but on the other hand, ambiguity related to U.S. trade and tariff policies in 2025 has led some investors to show more caution. Some of the private equity firms are taking short-term or staged investing plans as opposed to long-term, infrastructure-intensive projects by leasing plants instead of constructing them, or deferring wholesome acquisitions through bridge financing. Such recalibration is an indication of a more balanced opinion that, despite the long-term potential known to all about the geographic advantage of Mexico, strategic threats to geopolitical stability in the short term were considered.

Rise of Private Credit

Closure of traditional bank credit in Mexico has created a vital opportunity for the funds of the private credit funds, which are quickly proceeding to fund the underserved groups, especially the small and midsize businesses. Mezzanine debt financing, asset-based financing, and revenue-based financing all involve non-dilutive financing and are becoming increasingly popular with mid-sized businesses who can no longer get loans because formal financial institutions have been risk-averse. This trend has been picking up among domestic operators and also foreign funds, which are witnessing better returns as well as less competition than equity deals. Consequently, the niche game of private credit has become a more popular addition to the Mexican PE market, as the interest rates and inflation control grow stable.

Digital Adoption & ESG Integration

An increasing amount of interest is focused on digitalization and Environmental, Social, and Governance (ESG) integration of the private equity operations in Mexico. Digital transformation extends to the applications of AI in deal sourcing systems and investor reporting systems built in the cloud to create greater transparency and efficiency in operations. Meanwhile, the limited partners, especially the international institutional investors, are putting more stress on ESG compliance. This is encouraging companies to standardize the ESG structures, perform impact assessments, and establish the policies of responsible investing. The outcome is an improved and responsible private equity atmosphere and a more advanced market in the Latin American investment arena, in Mexico.

Click here to view the Report Description & TOC https://univdatos.com/reports/mexico-private-equity-market

Mexico's Private Equity Momentum: A Market Ready to Scale

The Mexican private equity market enters an evolutionary stage due to global re-balancing, the breakthrough in digitalization, and economic melts within the areas. The fact that the country has very solid fundamentals, including the benefit of nearshoring, and a high level of tech-driven entrepreneurship, is making it a fast favorite as regards where regional and global investors are looking to put their eggs. With increased advanced strategy, acceptance of alternative structures of deals, and accessibility to previously underdeveloped domains such as fintech, logistics, and healthcare, the market is likely to experience continuous growth. In the medium-long term, macro and regulatory headwinds will be irrelevant, so the forecast will be bullish, with Mexico being one of the strongest, most resilient, and opportunity-abundant private equity ecosystems of Latin America.

Related Report

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Invoice Factoring Market: Current Analysis and Forecast (2024-2032)

Insurtech Market: Current Analysis and Forecast (2024-2032)

Neo Banking Market: Current Analysis and Forecast (2023-2030)

MENA Fintech Market: Current Analysis and Forecast (2023-2030)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness