Invoice Factoring Market Overview, SME Financing Trends and Forecast Study (2024-2032) |UnivDatos

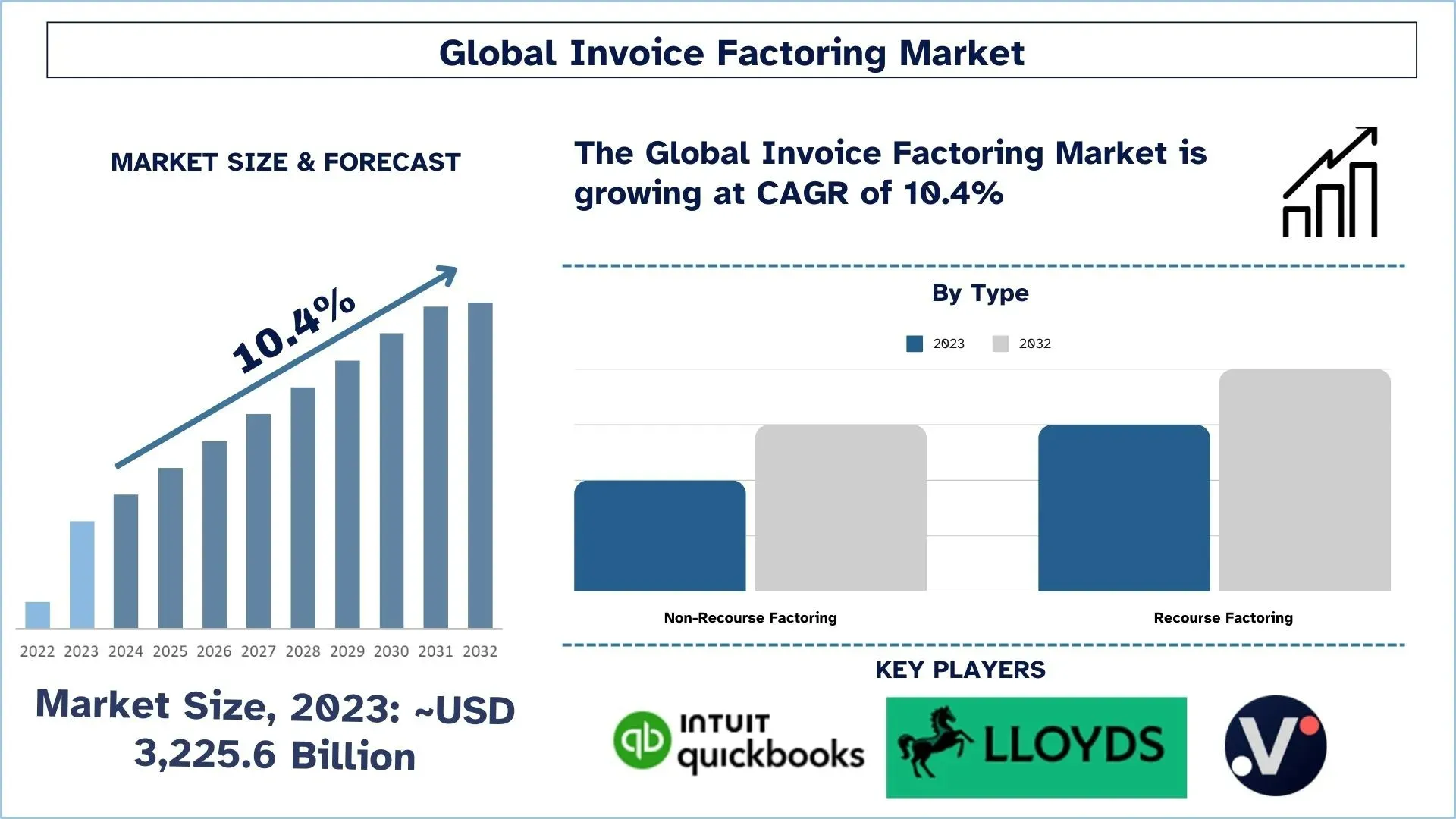

According to a new report published by UnivDatos, The Global Invoice Factoring Market was valued at USD 3,225.6 Billion in 2023 and is expected to grow at a strong CAGR of around 10.4% during the forecast period (2024-2032) Worldline the international payment service provider along with BNP Paribas Fortis the Belgian bank established a renewed partnership that will extend for at least five years starting from February 2024.

Access sample report (including graphs, charts, and figures) https://translation.univdatos.com/reports/invoice-factoring-market?popup=report-enquiry

At a fast-paced Invoice factoring has become essential financial support for United States businesses because it releases working capital trapped within unpaid invoices. A growing number of businesses now choose to factor in among the minority who used it in the past despite its increasing popularity.

Various business conditions drive an increase in invoice factoring demand throughout the United States.

Businesses that use invoice factoring can obtain quick cash access to pay daily operational costs and sustain their regular business functions.

Through factoring businesses can access funds without needing collateral or a good credit history thus making this financing option available to businesses who cannot get bank ***s.

News about FinTech has improved the invoice factoring process through efficient and user-friendly systems that enhance access to financing options for companies.

A business's marketplace condition defines the amount of accessible working capital through invoice factoring because the approach grows together with sales.

Bills with extended payment terms ranging from trucking to healthcare and oil and gas industries and manufacturing enable invoice factoring to be an efficient method for maintaining operable cash reserves.

Strategic business uses the enhanced cash flow generated from invoice factoring in different operational ways:

· Staffing and hiring new employees.

· Investing in marketing and advertising.

· Paying rent and recurring bills.

· Purchasing inventory to increase margins.

· Buying materials for projects.

Recent Developments/Awareness Programs: - Several key players and governments are rapidly adopting strategic alliances, such as partnerships, or awareness programs: -

For instance, in July 2021, RTS Financial Service, a U.S.-based factoring company, announced a partnership with PCS Software, an AI-driven transportation management platform leader, to provide better factoring capabilities and fuel savings to PCS Software’s marketplace of API-connected applications. This partnership will drive disruptive innovation for medium to large-sized enterprise brokers, carriers, and shippers in Canada and the U.S. These benefits will supplement the growth of the market during the forecast period.

In September 2024, 1st Commercial Credit LLC announced the development of its services with the introduction of international invoice factoring for inbound sales. Furthermore, this new offering provides financial assistance to foreign businesses by factoring invoices from U.S.-based buyers importing goods from Latin America, Asia, and select European countries. With this development, foreign companies involved in international trade can enhance their cash flow by obtaining immediate financing on invoices supported by credit-insurable U.S. buyers.

For instance, in November 2020, Nav, a U.S.-based financial services company, launched a next-generation emended finance platform for small businesses. Features of the new platform included dynamic financing profiles and a full-service funding manager team, which would be used to improve predictions, deliver new products, and boost customer engagement and retention.

Click here to view the Report Description & TOC https://translation.univdatos.com/reports/invoice-factoring-market

Conclusion

US companies that require extra cash flow and growth fuel need invoice factoring as an effective answer to these needs. The process of converting outstanding invoices to instant working capital lets companies gain advantages to fulfill their commitments pursue growth initiatives and manage their accounts receivables independently. Companies across the US will continue to rely on invoice factoring as they understand its key benefits for financial operations.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness