Dental Insurance Market Share, Coverage Expansion and Industry Forecast 2025-2033) |UnivDatos

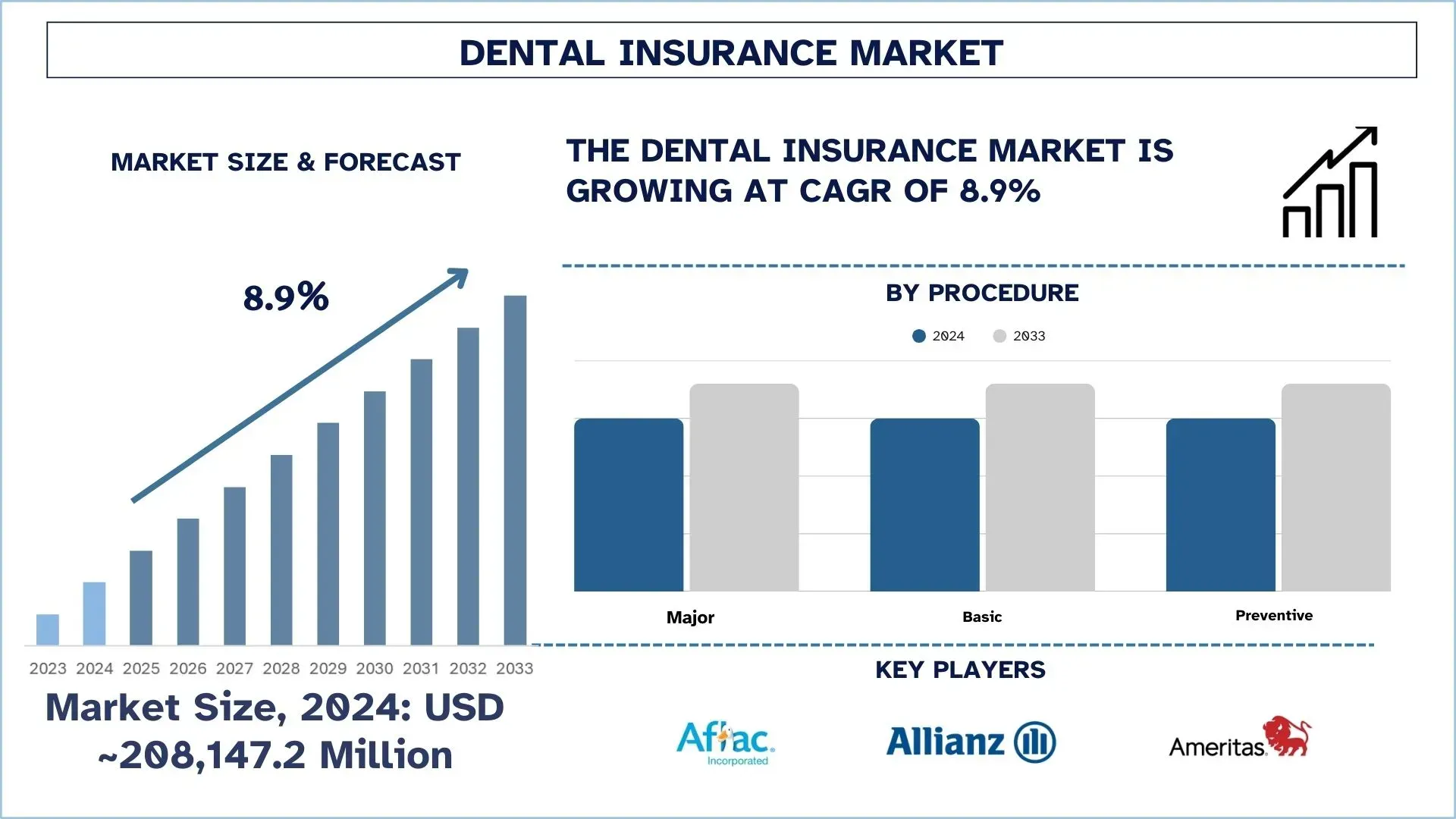

According to the UnivDatos, rising awareness of oral health and the increasing costs of dental treatments in emerging markets drive the Dental Insurance market. As per their Dental Insurance Market report, the global market was valued at USD 208,147.2 Million in 2024, growing at a CAGR of about 8.9% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

Access sample report (including graphs, charts, and figures) https://univdatos.com/reports/dental-insurance-market?popup=report-enquiry

The current dental insurance market tops double-digit capital growth, which is due to the increasing prevalence of health costs, improved awareness of dental health, as well as the current trends in the increasing demand for preventive measures. Prominent stakeholders in the market are now integrating various cutting-edge technologies like AI, telehealth solutions, and mobile applications targeting customer interaction, efficient claim management, and better client care. Some of the industry players are Aflac Inc., Allianz SE, and Cigna, which are not only trying to include more choices for consumers but also are diverse to better at the constantly evolving needs of consumers for more diversified dental insurance plans. Considering these factors, the prospects of the market seem very promising, as, following the tendencies, the global market will expand in the future due to the availability of the services, the digital presence, and the introduction of new technologies that would help meet the constantly increasing demand for high-quality and affordable dental services.

Aflac Inc.

Aflac Incorporated, through its subsidiaries, provides supplemental health and life insurance products. The company operates in two segments, Aflac Japan and Aflac U.S. The Aflac Japan segment offers cancer, medical, nursing care, whole life, and GIFT insurance products, as well as WAYS and child endowment, and Tsumitasu insurance products in Japan. The Aflac U.S. segment provides accident, disability, cancer, critical illness, hospital indemnity, dental, vision, and life insurance products in the United States. The company sells its products through individual, independent corporate, and affiliated corporate agencies; banks; independent associates/career agents; and brokers. Aflac Incorporated was founded in 1955 and is based in Columbus, Georgia.

Allianz SE

Allianz SE, together with its subsidiaries, provides property-casualty insurance, life/health insurance, and asset management products and services Internationally. The company’s Property-Casualty segment offers various insurance products, including motor liability, accident, fire and property, legal expense, credit, and travel to private and corporate customers. Its Life/Health segment provides a range of life and health insurance products on an individual and a group basis, such as annuities, endowment and term insurance, and unit-linked and ***-oriented products, as well as private and supplemental health, and long-term care insurance products. The company’s Asset Management segment offers institutional and retail asset management products and services to third-party investors comprising equity and fixed income funds, cash, and multi-assets; and alternative *** products that include real estate, infrastructure debt/equity, real assets, and liquid alternatives. Its Corporate and Other segment provides banking services for retail clients, as well as digital *** services. Allianz SE was founded in 1890 and is headquartered in Munich, Germany.

Click here to view the Report Description & TOC https://univdatos.com/reports/dental-insurance-market

Ameritas Life Insurance Corp.

Ameritas Life Insurance Corp is an Omaha-based mutual insurance company authorized to underwrite all sorts of insurance products, such as life insurance, dental insurance, vision care options, and mutual fund services for retirement. It provides its customers with excellent service and has been developing new insurance products that will best cater to the needs of its customers in the long run. The company offers its insurance directly to individuals and through employer programs and has been associated with offering affordable and sound insurance services. Being a member of the Ameritas Mutual Holding Company, the organization provides its clients with financial security while focusing on its stable script and development.

Axa S.A.

AXA SA, through its subsidiaries, insurance, asset management, and banking services worldwide. The company operates through six segments: France, Europe, AXA XL, Asia, Africa & EME‑LATAM, AXA *** Managers, and Transversal & Other segments. It offers life and savings insurance and property and casualty insurance products. The company also provides protection and retirement products for individual and professional customers; reinsurance coverages; property, primary and excess casualty, excess and surplus lines, environmental liability, professional liability, construction, marine, energy, aviation and satellite, fine art and species, livestock and aquaculture, accident and health, and crisis management. In addition, it offers reinsurance solutions with casualty, property risk, property catastrophe, specialty, and other reinsurance; proportional and non-proportional, and facultative reinsurance; risk management solutions and consulting services; integrated ecosystem combining medical assets with insurance services, which includes onsite services in clinics, remote teleconsultation and digital services, and home services; travel insurance and assistance services, as well as AXA Multilink platform; mobility virtual payment card; parametric insurance; and parametric flight delay product and an eSim card. Further, the company provides asset management services in the various asset classes and multi manager solutions. Additionally, it offers motor, household, property and general liability, health, term life, whole life, universal life, endowment, deferred and immediate annuities, and other ***-based products for retail/individual and commercial/group customers. AXA SA was founded in 1852 and is headquartered in Paris, France.

HDFC ERGO General Insurance

HDFC ERGO General Insurance Company Limited offers general insurance products in India. The company offers motor, health, accident, travel, commercial, specialty and weather/crop, home, cyber, third-party vehicle, tractor, goods and passenger carrying vehicles, and other insurance products. It also provides corporate insurance products, including casualty, group, property and miscellaneous, specialty, and other insurance; and rural insurance products, such as cattle and rainfall index insurance. The company offers its products through brokers, retail, corporate agents, bancassurance, and a direct sales force. HDFC ERGO General Insurance Company Limited was formerly known as HDFC General Insurance Company and changed its name to HDFC ERGO General Insurance Company Limited in July 2008. The company was founded in 2002 and is headquartered in Mumbai, India. HDFC ERGO General Insurance Company Limited operates as a subsidiary of HDFC Bank Limited.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness