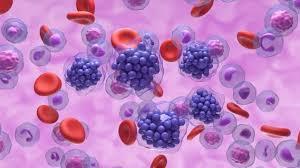

Targeted, Cell and Biomarker‑Driven Therapies Drive 8% CAGR to 2030

Global Market Overview

The Diffuse Large B‑Cell Lymphoma (DLBCL) Therapeutics Market reached approximately USD 4.02 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 7.9%, reaching USD 6.36 billion by 2030. Additional forecasts suggest the market could exceed USD 5.4 billion by 2035, driven by rapid innovation, expanded treatment access, and increasing disease prevalence.

DLBCL is the most common subtype of non Hodgkin lymphoma (NHL), accounting for 30–40% of all NHL cases globally. A growing aging population, advancements in treatment modalities, and a surge in diagnostics are creating favorable conditions for continued growth.

Sample Report : https://www.datamintelligence.com/download-sample/ Diffuse Large B-cell Lymphoma Therapeutics Market

Key Market Drivers

-

Rising Incidence of DLBCL

Increasing global incidence especially in aging populations continues to drive demand. In the U.S. alone, over 81,000 new NHL cases were diagnosed in 2022, with DLBCL comprising a significant portion. -

CAR‑T Cell Therapy Expansion

Chimeric antigen receptor T‑cell (CAR‑T) therapies like Yescarta and Breyanzi have transformed second line and refractory treatment paradigms with durable remissions, particularly for patients not eligible for transplant. -

Emergence of Bispecific Antibodies

Therapies like Epcoritamab (Epkinly) and Glofitamab (Columvi) offer off the shelf alternatives to CAR‑T, with strong efficacy and shorter administration timelines. These agents are increasingly approved for relapsed/refractory DLBCL. -

Frontline Innovations with ADCs

Polatuzumab vedotin (Polivy), when combined with R‑CHP, has shown superior response rates compared to traditional R‑CHOP, signaling a shift in first line therapy protocols. -

Growing Use of Biosimilars

The approval and growing uptake of Rituximab biosimilars help reduce therapy costs and expand global access, especially in lower income healthcare markets. -

Shift Toward Outpatient Therapy

Novel treatments with improved safety profiles and shorter administration times enable transition from hospital to outpatient clinic settings, enhancing accessibility and reducing burden on healthcare systems.

Customize Report :https://www.datamintelligence.com/customize/ Diffuse Large B-cell Lymphoma Therapeutics Market

Regional Market Insights

United States

-

The U.S. holds the largest share of the global market, accounting for about 45% of global DLBCL therapeutics revenue.

-

The market is projected to grow from USD 2.0 billion in 2023 to USD 3.6 billion by 2031, fueled by continued innovation and a strong regulatory framework.

-

The U.S. leads in CAR‑T therapy adoption and bispecific antibody approvals, supported by an extensive clinical trial ecosystem and payer infrastructure.

Japan

-

Japan is emerging as a high growth market, especially with expanded access to CAR‑T cell therapy. Yescarta and Breyanzi have been introduced at certified treatment centers with increasing adoption.

-

A rapidly aging population and supportive government healthcare policies have spurred demand for advanced immunotherapies.

-

With more DLBCL patients being treated in outpatient settings, Japan is actively investing in infrastructure and professional training to support novel therapeutic adoption.

Buy this Report :https://www.datamintelligence.com/buy-now-page?report= Diffuse Large B-cell Lymphoma Therapeutics Market

Therapeutic Landscape

*** Classes:

-

Monoclonal Antibodies: Rituximab and biosimilars remain the cornerstone in both frontline and maintenance therapy.

-

Antibody–*** Conjugates (ADCs): Polivy is gaining prominence in first line settings.

-

CAR‑T Therapies: Yescarta and Breyanzi dominate third line and relapsed/refractory segments.

-

Bispecific Antibodies: Epkinly and Columvi represent a new class of off the shelf treatments with high potential.

Therapy Settings:

-

Hospitals: Still the primary setting for CAR‑T and initial therapy.

-

Clinics & Outpatient Centers: Rapidly growing, particularly for bispecific antibody delivery and maintenance infusions.

Innovation Pipeline

-

Next Generation CAR‑T Therapies

Efforts are underway to develop off the shelf, allogeneic CAR‑T therapies with faster turnaround and broader patient eligibility. -

Targeted Oral Therapies

Bruton's tyrosine kinase (BTK) inhibitors and BCL2 inhibitors are being explored for specific genetic DLBCL subtypes, allowing tailored treatment strategies. -

Combination Immunotherapy

Trials combining checkpoint inhibitors, bispecifics, and CAR‑T therapies aim to boost efficacy in high risk and refractory populations. -

Minimal Residual Disease (MRD) Monitoring

The integration of MRD diagnostics into treatment response assessment is gaining traction and may guide therapy escalation or de escalation.

Source: Secondary Research, Primary Research, DataM Intelligence Database and ***yst Review

Strategic Growth Opportunities

|

Growth Area |

Strategy Recommendation |

|

CAR‑T Therapy Access |

Expand certified infusion sites in APAC & Latin America. |

|

Biosimilar Development |

Collaborate with local partners for cost effective Rituximab biosimilars. |

|

Frontline Therapy Innovation |

Invest in education for ADC integration in first line regimens. |

|

Digital & Real World Data Platforms |

Build MRD and clinical ***ytics for post market tracking. |

|

Outpatient Therapy Enablement |

Develop outpatient specific administration and reimbursement models. |

Strategic Recommendations

-

Expand CAR‑T access through strategic partnerships and clinic accreditation, especially in Japan and Southeast Asia.

-

Scale biosimilar availability in price sensitive regions to democratize access to core therapies like Rituximab.

-

Promote frontline adoption of newer regimens (e.g., Polivy + R‑CHP) via clinician training and real world evidence sharing.

-

Accelerate outpatient transitions with focused care models for bispecific and immunotherapy agents.

-

Develop companion diagnostics for biomarker driven personalization in treatment selection.

Subscribe :https://www.datamintelligence.com/reports-subscription

Conclusion

The global Diffuse Large B‑Cell Lymphoma Therapeutics Market is set for transformative growth, expanding from USD 4.0 billion in 2024 to over USD 6.3 billion by 2030. The shift from traditional chemotherapies to targeted immunotherapies, combined with enhanced outpatient delivery and global access, is reshaping the DLBCL treatment landscape.

With the U.S. leading in approvals and adoption and Japan scaling CAR‑T therapy access rapidly, stakeholders that invest in innovation, affordability, and infrastructure stand to lead the next chapter in hematologic cancer care.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness