Canada’s Advanced Wound Care Market to Surge to CAD 1.2 B by 2034

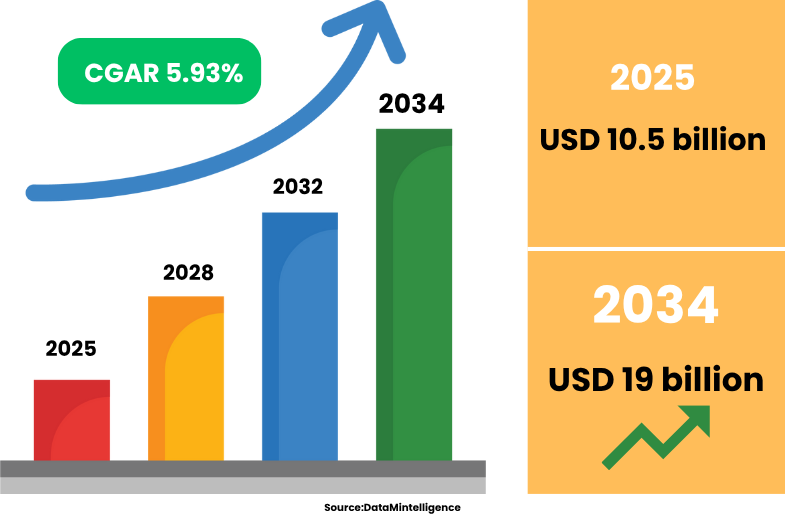

Canada’s advanced wound care market is entering a significant growth trajectory, spurred by rising chronic diseases, healthcare digitization, and adoption of next-generation wound care technologies. According to OG ***ysis, the global advanced wound care market was valued at USD 10.5 billion in 2024, projected to grow at a CAGR of 5.93%, reaching USD 11.12 billion in 2025 and an estimated USD 19 billion by 2034. Canada is poised to align with—if not surpass—these global gains, given its robust healthcare infrastructure, supportive provincial programs, and accelerating demand from both institutional and home care sectors.

Unlock exclusive insights with our detailed sample report :

https://www.datamintelligence.com/download-sample/canada-advanced-wound-care-market

Market Outlook and Key Growth Drivers

Canada’s market is expected to grow steadily over the next decade, mirroring global trends and benefitting from North America’s overall leadership in wound care innovation. According to various industry projections, the global advanced wound care segment is forecast to rise from USD 11.82 billion in 2025 to USD ***04 billion by 2034, with North America holding the lion’s share of the global market.

Key factors driving growth in Canada include:

- Aging population and chronic disease prevalence: Canada’s senior population is expected to double by 2036, intensifying the need for long-term and chronic wound care—especially for conditions such as diabetic ulcers, pressure ulcers, and venous leg ulcers.

- Technological breakthroughs: Innovation in smart dressings, bioengineered skin substitutes, and remote wound monitoring tools is transforming clinical practice.

- Telehealth integration: The pandemic accelerated the use of virtual healthcare, enabling wound monitoring and consultation at home—ideal for elderly patients and those in rural or underserved areas.

- Hospital program expansion: Tertiary care hospitals in Ontario, Quebec, and British Columbia are integrating specialized wound care clinics, inspired by successful U.S. models such as Munson Healthcare.

Make an Enquiry for purchasing this Report :

https://www.datamintelligence.com/reports-subscription

Market Segmentation: Product, End-User & Application Insights

While Canada-specific segmentation is limited in published datasets, insights from North America-wide data—along with Canadian market dynamics—offer a clear picture:

1. By Product Type:

- Advanced Wound Dressings: These remain the dominant segment, comprising products like hydrocolloids, alginates, hydrogels, foam dressings, and film dressings. They are preferred for their moisture-retention capabilities and faster healing performance.

- Active Wound Care Products: Includes collagen-based dressings, growth factors, and skin substitutes—increasingly adopted in chronic wound management.

- Negative Pressure Wound Therapy (NPWT): Gaining traction in major hospitals for treating complex wounds, surgical site infections, and diabetic foot ulcers.

- Bioengineered and Smart Products: Early-stage but rapidly evolving; Canada’s tech hubs are collaborating with research hospitals to pilot diagnostic-enabled dressings, sensor-embedded bandages, and AI-driven wound tracking systems.

2. By End User:

- Hospitals and Specialty Clinics: Dominating usage due to availability of multidisciplinary teams and sophisticated treatment setups. Hospitals handle nearly 50% of wound care demand, in line with trends observed in Japan and the U.S.

- Long-Term Care Facilities: These are expanding their role, particularly for elderly and immobile patients with pressure ulcers or surgical wounds.

- Home Healthcare: Rapid growth is evident here, thanks to the surge in telewound care, wearable diagnostics, and caregiver training. Provinces like British Columbia and Ontario are pioneering mobile wound care teams and remote consultation platforms.

3. By Application:

- Diabetic Foot Ulcers: Among the top three chronic wound types in Canada.

- Pressure Ulcers: Especially prevalent in long-term care and geriatric settings.

- Venous Leg Ulcers and Surgical Wounds: A growing concern given the increase in surgical procedures and vascular complications in aging patients.

Regional Penetration: Ontario, Quebec, and Beyond

Canada’s wound care market is regionally concentrated in provinces with higher healthcare funding and urban populations:

- Ontario: As Canada’s most populous province, Ontario commands the largest market share, driven by its dense hospital network, strong *** in healthcare digitization, and access to skilled wound care professionals.

- Quebec: Follows closely behind with public and private initiatives supporting innovation in chronic wound care management. Montreal’s research institutions and hospital collaborations are advancing wound healing technologies.

- British Columbia: A leader in telehealth and home-care integration, especially through provincial pilots such as the BC Telehealth Network.

- Prairie Provinces (Alberta, Manitoba, Saskatchewan): Show moderate adoption levels, but increasing *** in rural and Indigenous health programs is expected to drive future growth.

- Remote & Indigenous Communities: Represent underpenetrated markets with significant unmet needs. Mobile wound care units and AI-supported remote diagnostics are crucial tools being explored for these populations.

Key Players in Canada’s Advanced Wound Care Landscape

Canada’s market is served by a combination of global giants, regional distributors, and health-tech startups:

Multinational Corporations:

- Smith & Nephew

- 3M Health Care

- ConvaTec Group

- Molnlycke Health Care

- Johnson & Johnson (Ethicon)

- Coloplast

These players offer a broad range of advanced dressings, NPWT systems, and digital wound care platforms and have established partnerships with Canadian hospitals and distributors.

Canadian Startups & Innovators:

- Swift Medical: A Toronto-based digital health company specializing in AI-powered wound imaging and ***ytics.

- Curexe Innovations: Known for smart hydrogel dressings with embedded sensors.

- Academic research labs: Particularly in Vancouver and Montreal, are involved in developing next-generation skin substitutes and regenerative materials.

Challenges in Market Maturity

Despite the optimistic outlook, the Canadian market faces several hurdles:

- Fragmented procurement across provinces leads to unequal access and slow technology uptake.

- High cost of smart products requires robust ROI studies to justify reimbursements.

- Workforce training gaps, especially for remote caregivers and community health workers, may hinder full-scale adoption—though mobile platforms are bridging these gaps.

Looking Ahead: A High-Potential Growth Frontier

By 2034, Canada’s advanced wound care market is projected to reach between CAD 1.2 billion to 1.5 billion, up from an estimated CAD 600–800 million in 2024, assuming a sustained CAGR of 5–6%. Several milestones are expected along the way:

- 2025–2027: Expanded hospital programs, pilot use of NPWT, and digital tools.

- 2028–2031: Mainstreaming of smart dressings and AI-enabled monitoring platforms.

- 2032–2034: Full tele wound care integration, improved reimbursement, and broader community access.

Buy the full report here:

https://www.datamintelligence.com/buy-now-page?report=canada-advanced-wound-care-market

Conclusion

Canada’s advanced wound care market is poised for robust and sustained growth. Backed by global innovation, strong healthcare infrastructure, and policy evolution, the country is well-positioned to become a North American hub for next-generation wound management. As smart materials, telehealth models, and regenerative therapies become standard, Canada’s healthcare system stands to gain not only economically but in delivering vastly improved outcomes for patients.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness