Patrocinados

Pre-engineered Buildings Market Growth Report — 2024 to 2031

Market Overview & Estimation

The pre-engineered buildings market was valued at about USD 21.47 billion in 2024, and is projected to reach approximately USD 57.79 billion by 2034, driven by a healthy 10.4% CAGR over that decade. Alternative estimates align: another key projection places the market at USD 17.1 billion in 2024, growing at an 8.5% CAGR to USD 32.8 billion by 2033, while a 10.41–11.6% CAGR is also reported. The consensus indicates strong growth, driven by industrialization, urbanization, eco-friendly construction, and fast-tracked, cost-effective building solutions.

To buy the report, click on https://www.datamintelligence.com/buy-now-page?report=pre-engineered-buildings-market

Key Highlights from the Report

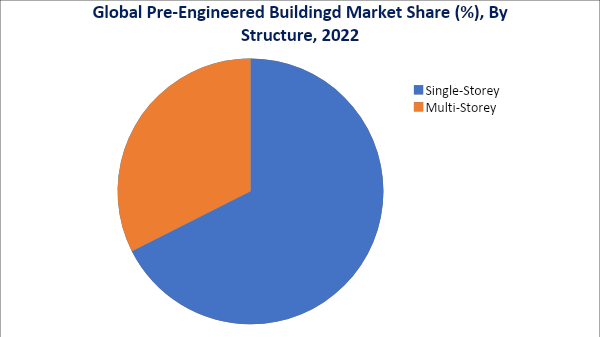

The PEB market is dominated by Asia-Pacific—accounting for roughly 35–47% of global revenue—with North America following closely at 30–37% share. Single-story structures currently dominate due to cost efficiency and simple ***gn requirements, yet the multi-story segment is gaining ground with higher projected growth. Commercial buildings are the primary application, though industrial facilities are expanding fastest—keenly reflecting e-commerce, logistics, and manufacturing growth.

Market Segmentation

The pre-engineered buildings ecosystem unfolds across several interlinked dimensions:

By Structure, the market is divided into single- and multi-story buildings. Single-story units are popular for warehouses, workshops, and retail complexes due to their rapid assembly, cost-effective construction, and spatial flexibility. Urbanization, higher land costs, and tech advancements are now fueling demand for multi-story PEBs in commercial and residential developments.

By Application, commercial facilities (offices, showrooms, retail malls) currently form the largest segment, while industrial applications (factories, logistics hubs, cold storages) are growing at a faster clip—revealing a nuanced shift as automation and supply chain infrastructure expand.

By Region, Asia-Pacific leads, underpinned by rapid industrial growth in China, India, Japan, and Southeast Asia. North America—especially the USA—holds a robust second position, while Europe and MEA contribute meaningful diversity in application spread.

For a sample report, https://www.datamintelligence.com/research-report/pre-engineered-buildings-market

Regional ***ysis: United States & Japan

United States

The U.S. pre-engineered building market was valued at approximately USD 4.59 billion in 2024 and is forecast to reach around USD 8.42 billion by 2030, with a 10.7% CAGR. Key drivers include the surge in warehouse and industrial facility construction—spurred by e-commerce and distribution infrastructure. Government incentives under green construction mandates and disaster-resilient housing programs further stimulate adoption. Leading American players include Kirby Building Systems and BlueScope Steel North America, who benefit from integrated manufacturing and EPC model delivery.

Japan

While explicit PEB figures for Japan are less widely published, its national construction industry contributed 28 trillion ¥ (~USD 180 billion) to GDP in recent years, yet faces labor shortages and high costs. These structural pressures drive interest in off-site and pre-engineered methods. Japan is also expanding adoption of green-building standards like CASBEE, incentivizing efficient, low-carbon structures. Major firms such as Daiwa House leverage PEB in logistics centers and commercial developments, indicating a steady shift toward more pre-fabricated, sustainable construction.

Latest Trends & Insights

-

Off-site construction is gaining traction globally—reducing build time by one-third, improving quality control, and cutting site waste by nearly half.

-

Green building certifications, such as CASBEE in Japan, are raising the profile and adoption of efficient PEB solutions.

-

Technological integration is advancing: Building Information Modeling (BIM), IoT-enabled sensors, and digital project tracking streamline workflows and reduce errors.

Top 5 Key Players & Strategic Moves

Here are the leading firms steering the PEB industry:

-

BlueScope Steel—a global steel and PEB specialist with large-scale regional projects and integrated supply chains.

-

Astron Buildings—Known for innovative PEB ***gn and turnkey capabilities across Asia and North America.

-

Everest Industries—*** market leader with significant forays into commercial and industrial building platforms.

-

Interarch Building Products—Major *** PEB provider active in diverse applications from warehouses to public infrastructure.

-

Kirby Building Systems—U.S.-based leader in light-gauge steel structures, serving industrial and commercial sectors.

Challenges & Opportunities

Challenges faced by the sector include volatility in steel prices, supply chain disruptions, and a shortage of skilled installers—especially in Japan.

Opportunities are substantial: growing urbanization, infrastructure ***s, and a shift toward sustainable and resilient buildings create favorable conditions. Asia-Pacific's leadership in industrial PEB use—alongside global green building momentum—positions the market for long-term expansion.