Mosquito & Fly Control Leads Pest‑Defense Market Globally

The global household insecticides market is expanding rapidly, driven by concerns around vector-borne diseases, eco-friendly product demand, urban sprawl, and innovation in formulations and tech. As per DataM Intelligence, the market will grow at a 5.2% CAGR from 2024 to 2031.

Request a sample copy of research report:https://www.datamintelligence.com/download-sample/household-insecticides-market

Market Overview & Growth Drivers

-

Market Size & Trajectory

The global segment grew from USD 19.76 billion in 2023 to a projected USD 33.17 billion by 2032, at a 6.8% CAGR (2024–32) . Allied Market Research estimates a rise from USD 15.2 billion in 2022 to USD 31.1 billion by 2032, at 7.5% CAGR. -

Public Health Pressure

More than 700,000 deaths annually are linked to vector-borne diseases like malaria and dengue. Rising disease incidence and government-led awareness campaigns—like the WHO’s strategic preparedness plans—have escalated demand. -

Urbanization & Climate Change

Rapid urban growth has intensified pest infestation rates, while warmer climates expand vector habitats. -

Eco‑friendly & Natural Trends

Natural formulations (citronella, neem, essential oils) held over 50% market share in 2022, reflecting consumer preference for safer, greener solutions . -

Technological Innovation

Advances include biopesticides, smart vaporizers, repellant paints, and long-lasting formulas.

Market Segmentation & Form Factors

By Composition

-

Natural: Largest share (>50%)

-

Synthetic: Fastest CAGR (~7.7%) due to performance and shelf-life

By Application

-

Mosquito control leads (>33% share) driven by disease prevention

-

Fly control fastest growing, with ~8.0% CAGR, rising hygiene concerns

By Form

-

Sprays dominate due to convenience and consumer familiarity (~4% CAGR in Asia Pacific).

-

Coils, vaporizers, gels, mats, baits, creams rounding out the portfolio.

Regional Highlights: US & Japan

United States

-

The U.S. leads North America and is seeing consistent demand from urban households and outdoor enthusiasts.

-

EPA is banning certain harmful chemicals (e.g., DCPA) and pushing for non-toxic alternatives.

-

Market gains from rise in non-toxic, residue-free formulas and online sales channels.

Japan

-

Accounts for over 13% share of Asia‑Pacific market growth .

-

Dense urban living and hygiene culture drive form-factor innovation (coils, paints, gels) .

-

Over 300 patents filed for efficient insecticides reflecting Japan's eco-conscious values like “mottainai”.

-

COVID-era data showed insect-repellent sales rising ~20–60% as people stayed indoors with windows open.

“Bug repellents sold ~20% more in Japan during COVID lockdowns…mite-specific products jumped ~60%,” reports Mainichi.

Opportunities & Innovations

-

Eco & Biopesticide Development

Incentives in US/EU have made biopesticides grow 10+% per year, faster than synthetic. -

Smart Home & IoT Integration

Automated vaporizers and app-controlled repellents address convenience-seeking consumers. -

E‑commerce & DTC Growth

Online channels enable remote purchase of diverse, niche formulations—especially in Asia Pacific and North America. -

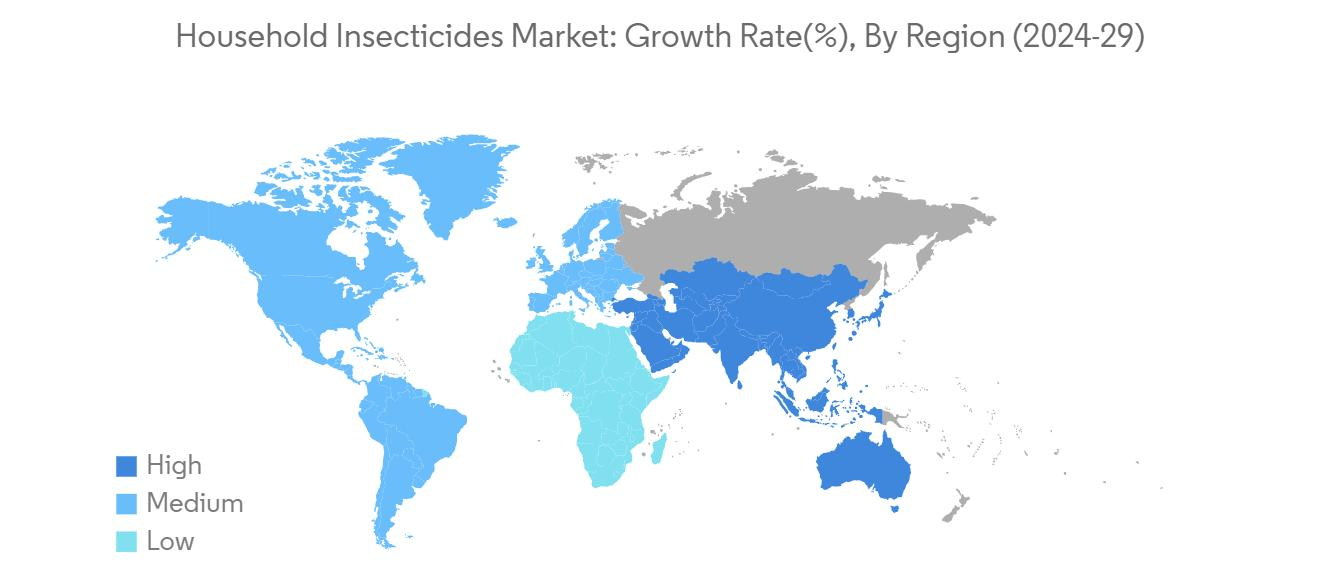

Emerging Markets

APAC (~43.6% share in 2024) has strong potential as urbanization and mosquito concerns rise. -

Product Line Extensions

Innovations like repellant paints, lotions, patches, and essential-oil-based options are gaining traction.

Challenges & Regulatory Overview

-

Chemical Resistance: Insect overexposure has bred resistance, prompting eco-innovation.

-

Regulations & Safety: Growing bans on older chemicals and tighter approvals (e.g., DCPA, neonicotinoids) limit options .

-

Health Concerns: Prolonged exposure to ingredients like citronella may cause skin irritation, and regulatory bodies like EPA/Health Canada caution usage .

Request a Quotation: https://www.datamintelligence.com/buy-now-page?report=household-insecticides-market

Strategic Outlook & Recommendations

-

Industry Players should prioritize R&D in biopesticides and long-lasting formulations.

-

Regulators need to balance vector control with safety—encouraging smart alternatives and stricter vetting.

-

Retailers & E‑commerce Platforms ought to expand branded, non-toxic, innovative formats to meet hygiene-conscious consumers.

Investors can seize growth in smart-home integration, APAC expansion, and eco‑driven innovations.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- משחקים

- Gardening

- Health

- בית

- Literature

- Music

- Networking

- לא משנה

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness