Japan Market to Grow 22% CAGR Through 2033, India Joins Race

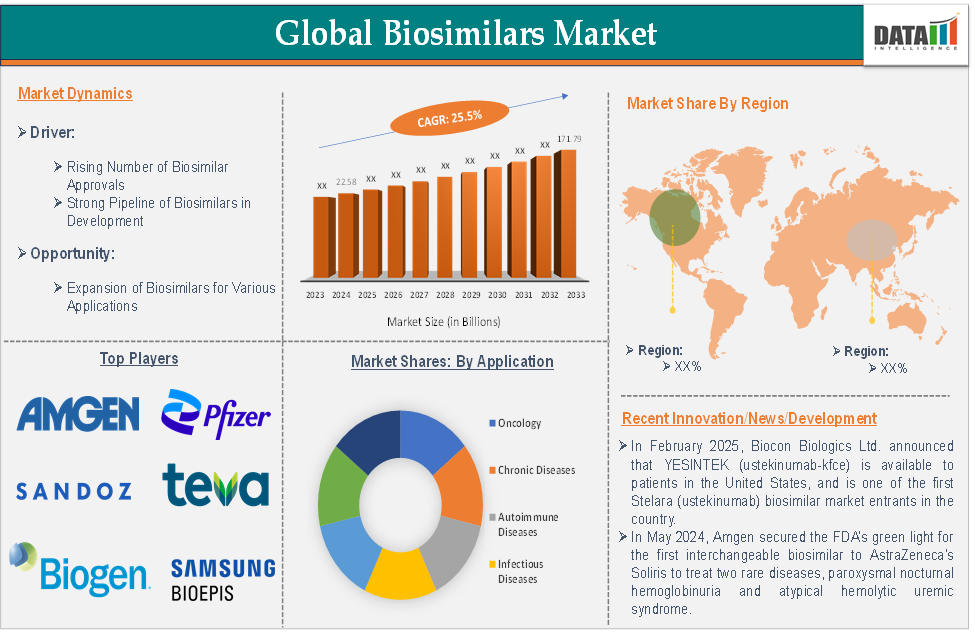

The biosimilars market—offering cost-effective, near-biologic therapies—is set for rapid expansion. India’s growing role complements major global momentum, driven by patent expirations, chronic disease prevalence, and supportive regulatory frameworks worldwide.

Biosimilars-market

Request a sample copy of research report:https://www.datamintelligence.com/download-sample/biosimilars-market

Powerful Market Momentum

-

Global Growth Forecast

The global biosimilars market was valued at USD 24 billion in 2024, with an expected CAGR of 19.6% to 2031, reaching USD 84 billion by then. -

Asia‑Pacific Leader

The Asia-Pacific segment accounted for USD 9.95 billion in 2024 and is projected to surpass USD 55 billion by 2032 (CAGR ***7%). India is the region’s fastest-growing market, expected to hit USD 2.725 billion by 2027.

India’s Strategic Biosimilar Rise

-

Domestic Market Outlook

Though exact current data from DataM Intelligence is proprietary, industry sources estimate India’s biosimilar sector will reach USD 35 billion by 2030, reflecting surging domestic R&D and biosimilar manufacturing. -

Industry Foundations

India boasts 670-plus USFDA-approved facilities, produces nearly half of global vaccine demand, and supports top biosimilar firms: Biocon Biologics, Intas, Dr. Reddy’s, Cipla, Aurobindo, Reliance Lifesciences. - Competitive Consolidation

M&A and strategic alliances (e.g., Abbott–mAbxience, Biocon–Sandoz) are consolidating expertise and accelerating launches.

Key Drivers & Market Dynamics

-

Patent Expirations Unlocking Markets

Loss of patents on blockbuster biologics—such as Herceptin, Rituxan, Enbrel, Humira and Stelara—fuels biosimilar entry. For example, Celltrion's CT-P43 (Stelara biosimilar) is set to enter the US in March 2025. -

Cost Savings & Access

Biosimilars cost 30–70% less than originators—e.g. Remicade’s vial at USD 500 vs. USD 1,600 for original—leading to potential savings up to USD 38 billion in US healthcare spend (2021–25). -

Chronic Diseases & Aging Demographics

Rising chronic disease burden (cancer, autoimmune, diabetes) and global aging populations are expanding biosimilar demand—even more pronounced in Japan with its geriatric demographics. -

Regulatory & Market Evolution

Streamlining by FDA, PMDA (Japan), and EMA—like BPCIA in the US (since 2010) and PMDA reforms—shortens market entry time. -

Competitive Consolidation

M&A and strategic alliances (e.g., Abbott–mAbxience, Biocon–Sandoz) are consolidating expertise and accelerating launches.

Trends in the US & Japan

United States

-

Retail & PBM Shifts

CVS’s launch of Cordavis and its biosimilar Hyrimoz (Humira biosimilar) reflects payor strategy shifts. US biosimilars projected at <USD 10B in 2022 to over USD 100B by 2029. -

Regulatory Expansion

As of October 2024, the FDA has approved 60 biosimilars. Under BPCIA, biosimilars are now interchangeable for prescriptions, reducing time and cost.

Japan

-

*** Growth

Japan’s market grew from USD 314.6 million in 2020 to USD 1.268 billion by 2027 (CAGR 22%). -

Domestic Surge

IMARC data forecasts growth from USD 475.8 million in 2024 to USD 3.42 billion by 2033 (CAGR 22.7%). -

Regulatory & Reimbursement Support

PMDA’s streamlined approvals, alignment with EMA/FDA pathways, and generous reimbursement drive rising biosimilar adoption in elderly care.

India-Specific Growth Opportunities

-

Chronic Disease Burden & Cost Pressure

India's rising diabetes, cancer, and autoimmune cases mirror global patterns—biosimilars can alleviate patient and government spending. -

Government & Regulatory Push

With supportive policies and evolving domestic approvals, India is poised to deepen its biosimilar space. -

Export Potential

Scaled production and quality, backed by USFDA production sites, strengthen India’s role as a global exporter of biosimilars and biologics. -

Domestic Innovation

Startups and biotech INR 25,000 cr government funding are developing next-gen biosimilars and contract research/manufacturing (CRDMO) services. -

Strategic Collaborations

Partnerships (e.g., Biocon–Sandoz, Abbott–mAbxience) and expanding portfolios (e.g. oncology, immunology biosimilars) will increase India's global competitiveness.

Market Challenges

-

Manufacturing Complexity & Immunogenicity

Biosimilars require expensive, high-precision processes, adding to development risk. -

Physician & Patient Resistance

Lack of familiarity and perceived safety concerns slow adoption—especially in Japan . -

Pricing Pressure

Fierce competition leads to shrinking margins, as manufacturers seek differentiation beyond cost savings . -

PBM Strategies in US

Rebates and formularies can favor originators over biosimilars, complicating market entry .

Expert Opinion

“Patent expirations create lucrative biosimilar opportunities in oncology and autoimmune spaces,” notes Global Research Firm.

“Asia‑Pacific is the fastest-growing region, with India leading the charge thanks to expanded biosimilar production and affordable pricing,” says MarketsandMarkets.

Request a Quotation: https://www.datamintelligence.com/buy-now-page?report=biosimilars-market

Future Outlook

The biosimilars market is at a pivotal growth juncture. For India, aligning domestic capacity with regulatory support and global partnerships promises millions in healthcare savings and enhanced treatment access.

Strategic Recommendations:

-

Policymakers & Regulators should enhance interchangeability rules and reimbursement models.

-

Manufacturers must invest in high-quality production, biosimilar differentiation, and therapeutic innovation.

-

Healthcare Providers should be educated to build trust and expand biosimilar use.

-

Global Investors have opportunity in India’s rising biosimilar and biopharma sectors—propelled by CRO/CMO capabilities and export scale

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness