Post‑COVID Crop Recovery Spurs Market Rebound in North America

The US & Canada nitrification and urease inhibitors market reached USD 202.17 million in 2022 and is forecast to hit USD 315.24 million by 2030, growing at a CAGR of 6.2%. This surge is driven by rising nitrogen fertilizer usage, environmental regulation, crop yield optimization, and innovative products like high-strength NBPT formulations.

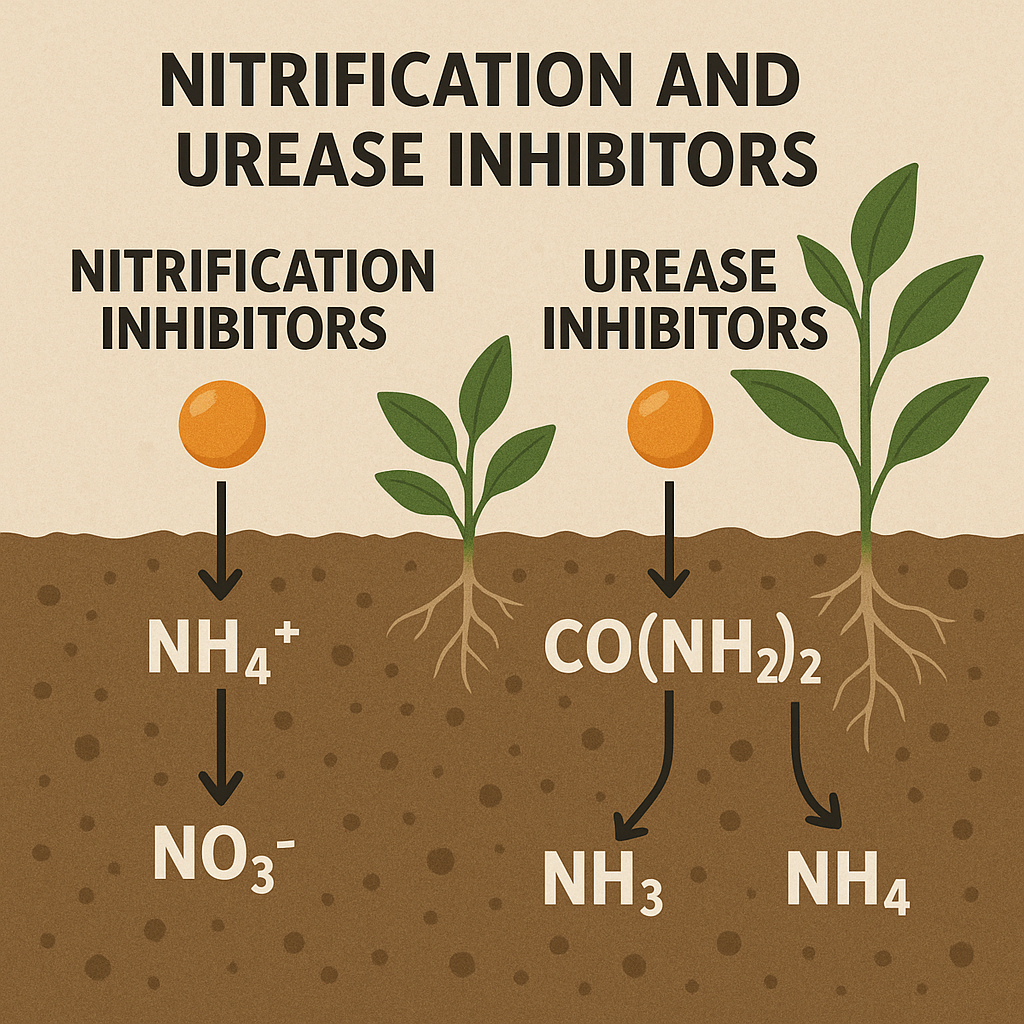

Nitrification-and-Urease-Inhibitors

Request a sample copy of research report: https://www.datamintelligence.com/download-sample/us-and-canada-nitrification-and-urease-inhibitors-market

🌱 Market Drivers & Growth Opportunities

1. Enhanced Regulatory & Environmental Focus

Farmers and policymakers are increasingly prioritizing sustainable farming practices. Inhibitors are now seen as critical for reducing nitrogen loss via volatilization, nitrification, and denitrification—helping protect water quality and cut greenhouse gas emissions.

In Canada, stricter import and sale regulations now classify inhibitors as “supplements” under the Fertilizers Act, requiring Level III safety and efficacy data—a move that underscores the growing importance of formal oversight.

2. Food Security & Crop Productivity Pressures

With urban food costs in the US rising ~11.4% by late 2022, there's growing urgency to increase agricultural yield and resource efficiency.

In Western Canada's no-till systems, trials showed inhibitor usage recovered up to 45% of applied urea nitrogen, compared to ~36% without additives—highlighting their effectiveness in boosting fertilizer recovery.

3. Emissions Reduction Commitments

Canadian trials in winter wheat recorded ~30% reductions in nitrous oxide emissions with inhibitors—supporting environmental targets tied to the 4R nutrient stewardship initiative.

4. Rising Fertilizer Adoption & Precision Agriculture

North America's heavy fertilizer usage—accounting for 12.8% of global nitrogen consumption in 2018—drives inhibitor demand.

Meanwhile, precision farming and fertigation systems enhance inhibitor uptake via targeted application—mirroring trends seen across APAC.

5. New Product Innovations

January 2023 saw Soilgenic Technologies introducing Visio‑N Supra, a 40% NBPT formulation that sets a new benchmark for concentrated urease inhibitors in Canada.

🇺🇸 Regional Snapshot: United States

- In 2019, the US inhibitor market was approximately USD 398 million—about 81% of the North American total.

- High fertilizer dependence, hydraulic precision farm deployment, and environmental regulation (e.g., US EPA Groundwater Protection Rule) are key growth drivers.

- Post-COVID recovery saw renewed momentum as farmers refocused on productivity and environmental stewardship.

🇨🇦 Spotlight: Canada

- Canada requires inhibitor products to undergo stringent regulation via the CFIA under the Fertilizers Act; nitrification inhibitors also require PMRA oversight under the Pest Control Products Act.

- CFIA is emphasizing robust safety, environmental, and efficacy data—raising the bar for product entry.

- Canadian companies are innovating rapidly; Visio‑N Supra provides higher NBPT concentration, enabling reduced application volumes.

- Prairie-based trials confirm inhibitor benefits for wheat and pulse crops—crucial to Canada’s agricultural landscape.

📈 Market Segments & Forecasts

- Market Value & Growth:

USD 202.17 million in 2022 → USD 315.24 million by 2030 (CAGR 6.2%). - Type Breakdown:

Includes nitrification inhibitors (e.g., nitrapyrin, DCD, DMPP) and urease inhibitors (e.g., NBPT, PPDA). - Application Method:

Fertigation is emerging as a leading method, thanks to improved fertilizer delivery systems; however, foliar and broadcast approaches remain widespread. - Crop Focus:

Staples—cereals, oilseeds, pulses—are prime targets due to high fertilizer demand; horticulture and forestry show growing niche opportunities.

🔧 Challenges & Strategic Outlook

Raw-Material Cost & Regulation:

Inhibitor production relies on chemicals that face regulatory scrutiny and price volatility, increasing development and usage costs.

Formulation & Efficacy Variability:

Efficacy depends on soil type, climate, and crop, leading to variable results. Ongoing R&D aims to improve consistency.

Competitive Environment:

North America is an early adopter; major agri-tech firms are investing in advanced formulations to strengthen positions.

Opportunities in Precision & Sustainability:

Integration with digital farming platforms and expanding regulatory support creates a robust ecosystem for inhibitor integration.

Request a Quotation : https://www.datamintelligence.com/buy-now-page?report=us-and-canada-nitrification-and-urease-inhibitors-market

🏁 Conclusion

The US & Canada nitrification and urease inhibitors market stands at an inflection point—valued at roughly USD 202 million in 2022 and poised to reach USD 315 million by 2030 at 6.2% CAGR. Driven by environmental sustainability, evolving regulations, funding, crop yield demands, and innovative high-strength formulations, inhibitors are fast becoming essential tools in modern nutrient management.

In the US, large-scale farming and precision agriculture deepen the demand for these inhibitors, supported by regulatory protections. In Canada, stricter product registration and strong R&D efforts from domestic companies are solidifying a sustainable, efficient agricultural strategy.

Stakeholders focusing on optimized formulations, regulatory compliance, and precision delivery systems are well-positioned to benefit from this sustained growth cycle.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness