Heart Valve Devices Market Growth Accelerated by Advances in Valve Engineering

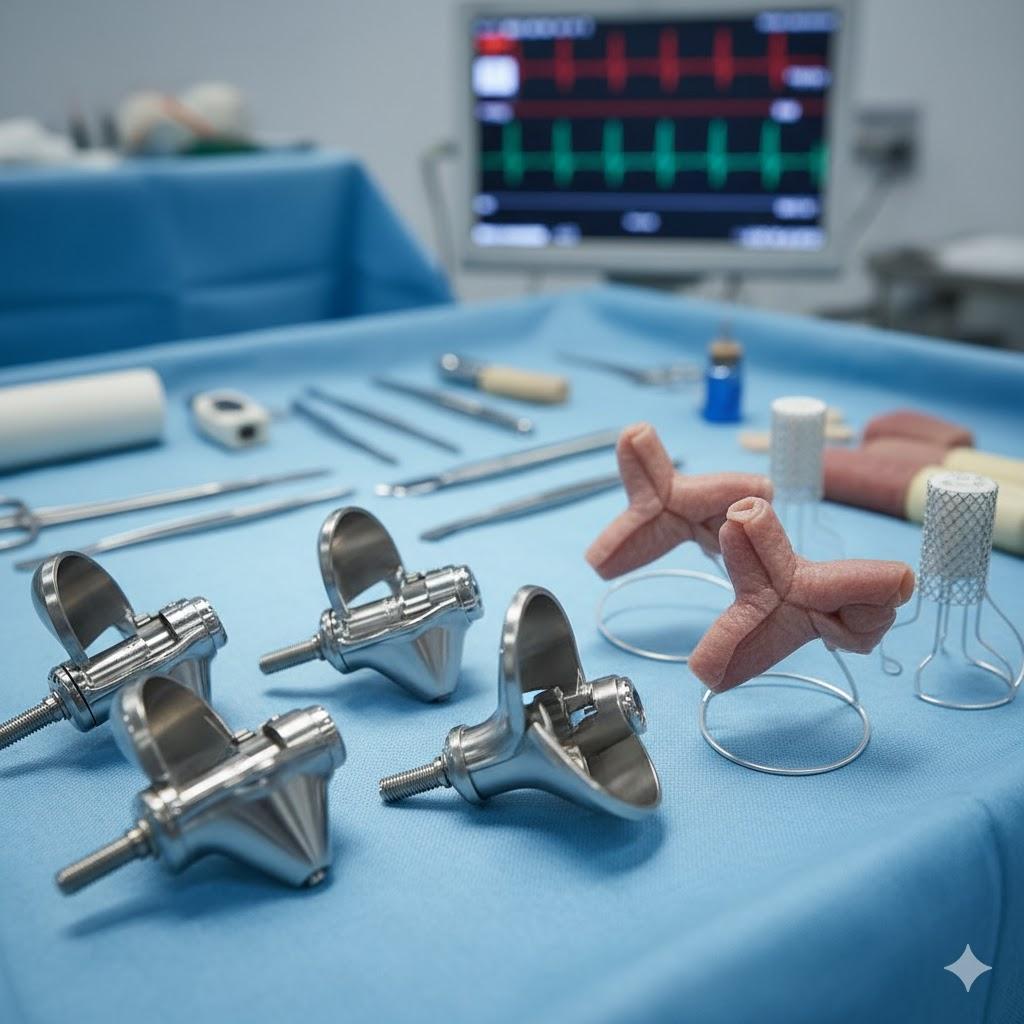

The global Heart Valve Devices Market is evolving rapidly as cardiovascular conditions and ageing populations place greater demand on innovative cardiac interventions. Heart valve devices ranging from mechanical and biological replacement valves to transcatheter and repair systems are critical in managing valvular heart disease, including aortic stenosis, mitral regurgitation and tricuspid disorders. These devices not only restore normal valve function but also enable less invasive procedures and faster recovery times, which amplifies their appeal in modern healthcare systems.

According to DataM Intelligence, the heart valve devices market reached approximately US$ 12.76 billion in 2024, and is projected to surge to around US$ 34.6 billion by 2033, reflecting a compound annual growth rate (CAGR) of about 12.34% through the forecast period. The primary growth drivers include rising prevalence of valvular disease due to aging demographics, expanded access to minimally invasive valve technologies (such as TAVI/TAVR), and continuous innovation in valve materials and designs. The leading segment within this market is the aortic valve replacement category, given the high incidence of aortic stenosis and the broad adoption of transcatheter aortic valve replacement procedures. Geographically, North America remains the dominant region, supported by strong healthcare infrastructure, high reimbursement levels for cardiac interventions, and early adoption of advanced device technologies.

Download Exclusive Sample Report: https://www.datamintelligence.com/download-sample/heart-valve-devices-market?jk

Key Development:

United States & Japan

In the United States, recent industry developments have highlighted major approvals and partnerships in the heart valve devices space. For example, certain leading manufacturers have gained U.S. Food and Drug Administration (FDA) clearance for novel repair and replacement valve systems, expanding the treatment options available to patients with complex valvular disease. These regulatory milestones accelerate clinical adoption and drive device sales upward. Moreover, U.S.-based medical device companies continue forging strategic alliances with hospitals and research centres to supply next-generation heart valve devices and integrated procedural services.

In Japan, the heart valve devices market is also witnessing notable developments. Japanese regulatory authorities are increasingly approving minimally invasive valve replacement systems, encouraging local device manufacturing and enhancing procedural volumes in hospitals. Partnerships between Japanese manufacturers and global device developers have expanded the availability of transcatheter mitral and tricuspid valve technologies, which historically had limited penetration in Asia. These developments are setting the stage for Japan to become a more significant growth region within the global heart valve devices market.

Key Players

The competitive ecosystem of the heart valve devices market is populated by large med-tech corporations and specialized structural heart companies that advance valve replacement and repair technologies. Key players in this space include:

• Abbott Laboratories

• Edwards Lifesciences Corporation

• Medtronic plc

• Boston Scientific Corporation

• Siemens Healthineers (structural heart division)

• Artivion, Inc.

• Meril Life Sciences Pvt. Ltd.

• NeoVasc Inc.

These organizations compete through product innovation, regulatory approvals, procedural partnerships and geographic expansion to capture market share in the evolving heart valve devices sector.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=heart-valve-devices-market

Growth Forecast Projected

Looking ahead, the heart valve devices market is poised for significant expansion.The market will grow more than two-and-a-half times from its 2024 base. The growth trajectory will be driven by several key trends: increasing prevalence of valvular disease in ageing populations; expanded indication approvals for transcatheter valve technologies into lower-risk patient populations; rising preference for minimally invasive procedures due to faster recovery and lower hospital stay; and geographic penetration into emerging markets where access to advanced cardiac care is improving. Market expansion will also be bolstered by continuous product upgrades (longer-lasting biological valves, next-generation transcatheter systems, hybrid repair/replacement options) and greater procedural volumes worldwide. As hospitals adopt more structural heart programmes and reimbursement pathways stabilise, the pipeline for heart valve devices appears robust.

Research Process

The report underlying this market analysis is built on a detailed research methodology that includes primary discussions with key stakeholders (device manufacturers, hospital procurement leads, clinical specialists), secondary data gathering from corporate filings and regulatory databases, and triangulation through data modelling and scenario analysis. Market forecasts account for historical trends, device pipeline dynamics, regulatory milestones, procedural volumes and adoption curves across regions. Sensitivity analyses are used to evaluate risks (e.g., reimbursement delays, procedural complications) and opportunities (emerging economies, innovative technologies). This comprehensive research process ensures that strategy-makers access actionable intelligence to guide decisions in device development, market entry, and competitive positioning.

Get Customized Report as per your Business Requirements: https://www.datamintelligence.com/customize/heart-valve-devices-market?jk

Key Segments

The heart valve devices market can be segmented along multiple dimensions:

Product Type: Mechanical heart valves, biological (tissue) heart valves, and transcatheter heart valves (TAVR/TMVR) including repair systems. Mechanical valves offer durability but require lifelong anticoagulation; biological valves are widely used for older patients; transcatheter systems support minimally invasive approaches for high-risk patients and increasingly intermediate/low-risk segments.

Treatment Approach: Replacement (open surgery, minimally invasive) and repair procedures. Repair technologies (mitral/tricuspid clip systems) are gaining traction as less invasive alternatives.

End-User / Setting: Hospitals and cardiac surgery centres, ambulatory surgical centres, and catheterisation labs. Hospitals dominate due to the high-complexity nature of valve procedures.

Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America leads in adoption; Asia-Pacific is expected to show the fastest growth due to rising healthcare access and procedural volumes.

Understanding these segments helps manufacturers, distributors and hospital systems tailor strategy whether focussing on transcatheter system innovation, expanding into ambulatory centres, or enhancing presence in emerging regional markets.

Benefits of the Report

In-depth quantitative market sizing and forecast for the heart valve devices market through 2033.

Detailed segmentation across product types, treatment approaches, end-users and geographies.

Insights into growth drivers and upcoming trends (e.g., transcatheter expansion, repair systems).

Competitive landscape analysis with key player profiles and strategic initiatives.

Identification of region-specific adoption dynamics and growth opportunities.

Pipeline and innovation overview of new heart valve technologies and biomaterials.

Pricing and reimbursement trends affecting device adoption and sales.

Risk factors and barrier assessment (regulatory, procedural complications, low-risk expansion challenges).

Strategic recommendations for device manufacturers, hospital procurement teams and investors.

Customisable elements in the report enabling tailored market intelligence to company strategy, product development or geographic focus.

Conclusion

In summary, the heart valve devices market represents a dynamic and rapidly growing segment of the cardiovascular devices industry. It offers significant opportunities for innovation, market expansion and clinical advances. The interplay of rising disease burden, procedural innovation (especially transcatheter and repair options), and geographic expansion into emerging healthcare markets underscores the depth of the opportunity. For medical device manufacturers, hospital systems and investors alike, aligning strategy with key segments (aortic valves, minimally invasive approaches, emerging markets) and staying ahead of competitive and regulatory shifts will be critical to capturing the gains ahead in the heart valve devices market.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness