India Fintech Market Size, Growth, Analysis, Trends and Forecast to 2032

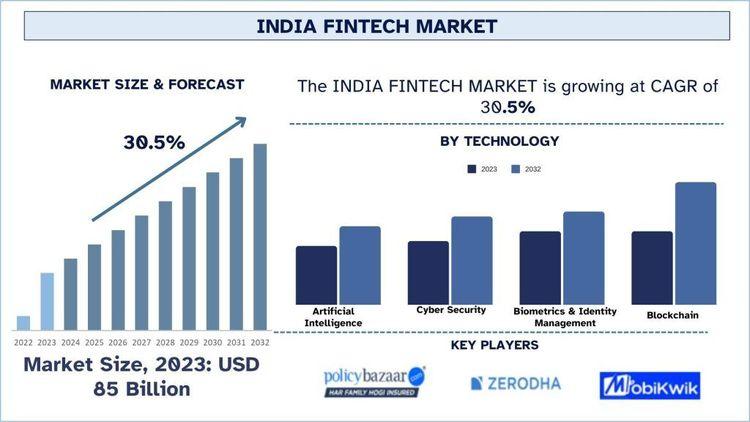

In recent years, India has emerged as a vibrant hub for fintech innovation, propelled by rapid digital adoption, entrepreneurial spirit, and supportive regulatory frameworks. India's fintech sector is transforming traditional financial services and paving the way for financial inclusion and economic growth. According to UnivDatos analysis, increasing infrastructure development and government initiatives will drive the global Fintech market scenario. As per their “India Fintech Market” report, the market was valued at USD 85 billion in 2023, growing at a CAGR of 30.5% during the forecast period from 2024 - 2032 to reach USD billion by 2032.

Market Dynamics and Growth Drivers

The fintech landscape in India is characterized by a diverse range of companies offering innovative solutions across various segments, including digital payments, lending, insurance, wealth management, and blockchain technology. Key factors driving the growth of India's fintech sector include:

Digital Payments Revolution: India's digital payments ecosystem has witnessed exponential growth, driven by initiatives like Unified Payments Interface (UPI). As of 2023, UPI transactions have surpassed billions annually, highlighting the rapid adoption of digital payment solutions.

Financial Inclusion: Fintech companies are addressing the gaps in traditional banking by providing accessible and affordable financial services to underserved populations. Platforms offering micro-loans, insurance products tailored to rural areas, and investment opportunities via mobile apps are expanding financial inclusion nationwide.

Technological Advancements: Advancements in AI, machine learning, and blockchain technology are enhancing the efficiency, security, and scalability of fintech solutions. These technologies enable personalized financial services, real-time fraud detection, and transparent transaction processing, driving customer trust and operational excellence.

Consumer Behavior Shift: Changing consumer preferences towards digital banking and online financial services have further accelerated the growth of fintech in India. Millennials and Gen Z, in particular, prefer seamless digital experiences and personalized financial solutions, which fintech firms are adept at providing.

Access sample report (including graphs, charts, and figures)- https://univdatos.com/reports/india-fintech-market?popup=report-enquiry

Regulatory Frameworks Supporting Fintech Innovation

India's regulatory environment plays a crucial role in fostering fintech innovation while ensuring consumer protection, financial stability, and regulatory compliance. Key regulatory frameworks that shape the fintech sector include:

Reserve Bank of India (RBI): As India's central bank, the RBI regulates payment systems, digital transactions, and fintech operations through guidelines and directives. Initiatives such as regulatory sandboxes allow fintech startups to test innovative products in a controlled environment before full-scale deployment.

Securities and Exchange Board of India (SEBI): SEBI regulates the securities market and oversees fintech platforms offering investment and trading services. Regulatory frameworks ensure investor protection, market integrity, and transparency in capital markets.

Insurance Regulatory and Development Authority of India (IRDAI): IRDAI regulates insurance products and services offered by fintech firms, ensuring compliance with insurance laws, consumer protection, and fair practices.

Data Privacy and Security: The Personal Data Protection Bill, which aims to regulate the collection, storage, and processing of personal data, will further enhance data privacy standards in the fintech sector, fostering consumer trust and confidence.

Future Prospects and Challenges

India's fintech sector is poised for continued growth and innovation. Key trends such as embedded finance, blockchain adoption, and the integration of AI-driven analytics will shape the future of financial services in the country. However, cybersecurity risks, regulatory complexities, and ensuring inclusive growth across diverse socio-economic segments will require concerted efforts from industry stakeholders and policymakers.

Conclusion

India's fintech sector presents vast opportunities for innovation, financial inclusion, and economic development. With robust regulatory frameworks and technological advancements, fintech firms are well-positioned to drive India's next digital transformation phase, reshaping the financial landscape to benefit businesses and consumers. As the sector continues to evolve, collaboration, adaptability, and regulatory clarity will be crucial in harnessing fintech's full potential to create a more inclusive and prosperous economy.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness