Europe Leads the Global Sustainable Finance Market with Robust Green Taxonomies and Climate Policy Frameworks

Sustainable Finance Market reached US$ 895.12 billion in 2024 and is expected to reach US$ 5,064.94 billion by 2032, growing with a CAGR of 24.19% during the forecast period 2025-2032.

Sustainable finance is a framework of financial practices and products that considers environmental, social, and governance (ESG) criteria alongside traditional financial metrics. Its purpose is to steer investment towards long-term sustainable economic activities and projects. Environmental factors include climate change mitigation, biodiversity, and pollution prevention; social factors address inequality, labor relations, and human rights; and governance pertains to transparent management structures. The goal is to create a financial system that supports a low-carbon, resource-efficient, and inclusive economy.

Download Sample:

https://www.datamintelligence.com/download-sample/sustainable-finance-market

Recent News

-

Global: The International Capital Market Association (ICMA) has issued new guidelines for sustainable bond reporting. There has been a notable increase in the issuance of sovereign green bonds, and new reports are highlighting the need for significant climate finance in developing nations, with India requiring a large sum for its decarbonization efforts.

-

U.S.: The U.S. Environmental Protection Agency (EPA) has announced new grants to improve recycling infrastructure, signaling continued government support for a circular economy. U.S. financial regulators have also been active, with new rules on ESG disclosures for funds and companies entering into effect, though some face legal challenges.

-

Japan: Japan is continuing to lead in sustainable finance, with Nomura Asset Management launching new ETFs designed to track sustainable indices. The Ministry of the Environment has also been actively promoting a circular economy through a new roadmap. Japanese firms are also expanding their climate-related reporting and participating in global initiatives to finance forestry projects.

Segmentation

-

By Investment Type: Equity, Fixed Income, Mixed Allocation, Others.

-

By Transaction Type: Green Bond, Social Bond, Mixed-Sustainability Bond, Others.

-

By End-User: Utilities Transport & Logistics, Chemicals, Food & Beverage, Government Sectors, Others.

Leading Companies

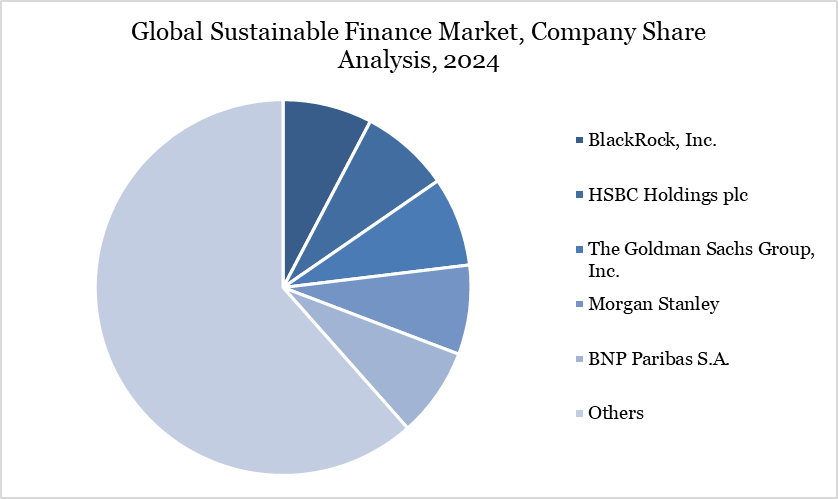

BlackRock, Inc., HSBC Holdings plc, The Goldman Sachs Group, Inc., Morgan Stanley, BNP Paribas S.A., Amundi S.A., The Vanguard Group, Inc., State Street Global Advisors, Inc., UBS Group AG, and Triodos Bank N.V.

Customization Report Link:

https://www.datamintelligence.com/customize/sustainable-finance-market

Market Trends

-

Diversification of Financial Products: The sustainable finance market is moving beyond traditional green bonds to include a wider range of products. New instruments like blue bonds for marine conservation, transition bonds for high-emission industries, and orange bonds for gender diversity are emerging to address a broader set of sustainability challenges.

-

Rise of ESG Data and Ratings: There is a significant and growing demand for high-quality, transparent, and consistent ESG data. Financial institutions and investors are increasingly relying on third-party reviewers and ESG rating agencies to assess the credibility of sustainable investments and mitigate the risk of greenwashing.

Business Opportunities

-

Development of New Financial Products: There is a clear opportunity to innovate and create new financial instruments that cater to specific sustainability goals, such as bonds that finance social housing or loans for companies transitioning to a low-carbon model.

-

ESG Data and Analytics Services: The demand for credible data on ESG performance is creating opportunities for businesses that can provide reliable data, ratings, and analytics. This includes consulting on ESG reporting, risk management, and compliance with new regulations.

Investment Analysis

-

Long-Term Growth: The market is poised for robust long-term growth, driven by global climate goals and shifting investor preferences, particularly among millennials and institutional investors.

-

High Demand for Green Assets: There is a significant capital supply ready to be deployed into sustainable projects, especially in sectors like renewable energy, sustainable infrastructure, and clean technology.

Buy Now:

https://www.datamintelligence.com/buy-now-page?report=sustainable-finance-market

Summary

The sustainable finance market integrates environmental, social, and governance (ESG) factors into investment decisions to generate both financial returns and positive societal impact. This rapidly growing sector is driven by increasing climate concerns, robust regulatory support, and a rising demand for sustainable investment products like green bonds. Key business opportunities lie in developing new financial instruments and providing ESG data and consulting services, making it a compelling area for investment, particularly in Asia, Europe, and North America.

Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and

global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ Technology Road Map Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

✅ Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

About DataM Intelligence

DataM Intelligence

4Market Research LLP offers real-time competitive intelligence in rare

diseases, respiratory health, and genetic therapies. We track pipeline trends,

clinical data, pricing insights, and market access to support better

decision-making across healthcare sectors.

🔗 Visit: www.datamintelligence.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness