India PCB (Printed Circuit Board) Market Size, Growth & Research Report (2025-2033) | UnivDatos

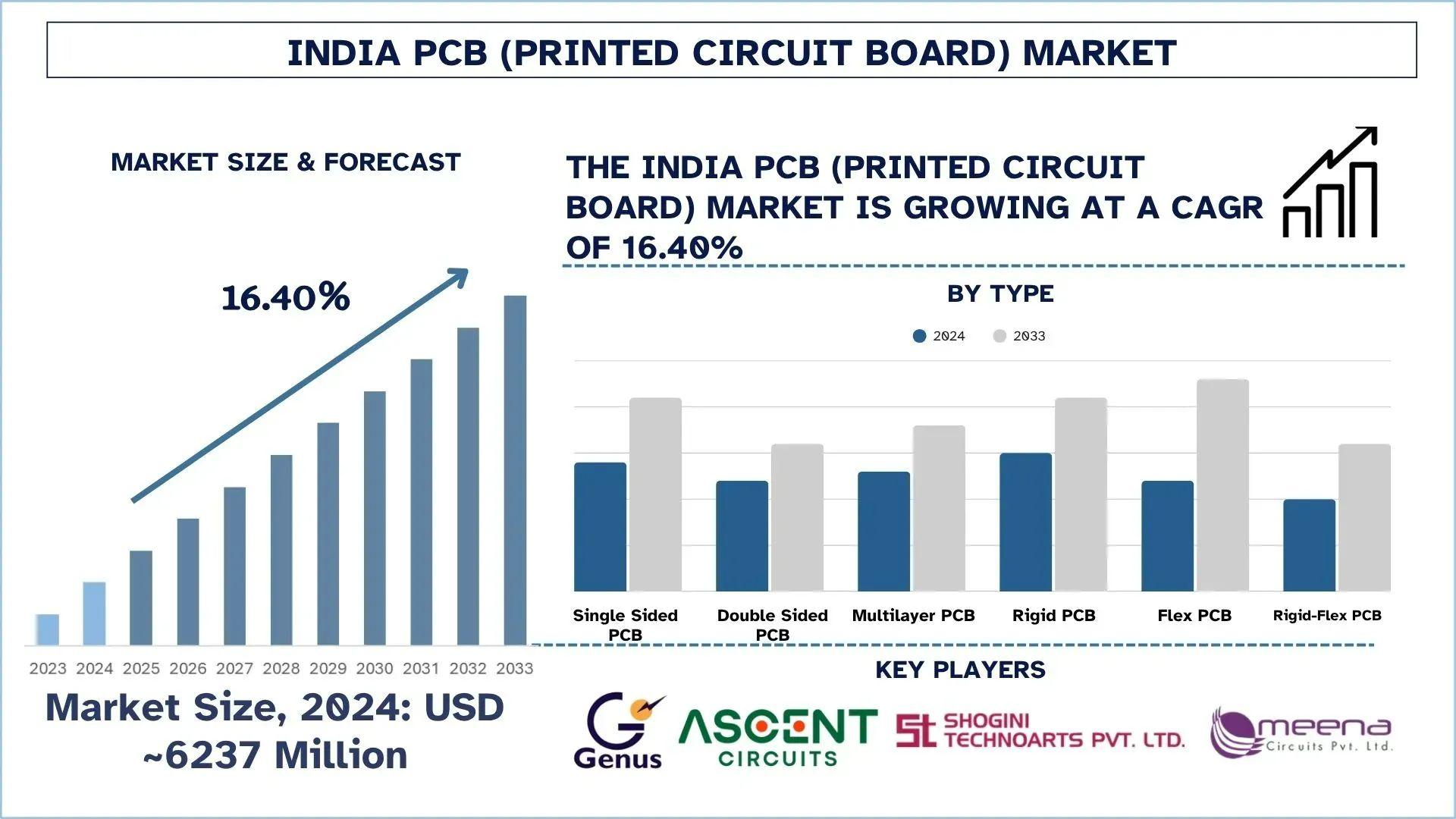

According to the UnivDatos, increased demand for industrial automation & robotics, rapid growth of consumer electronics manufacturing, rising adoption of IoT and smart devices, government push through ‘Make in India’ and PLI Schemes, rise of start-ups and local design houses driving prototype demand are driving the India PCB (Printed Circuit Board) market. As per their “India PCB (Printed Circuit Board) Market” report, the Indian market was valued at USD ~6237 million in 2024, growing at a CAGR of about 16.40% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The electronic manufacturing ecosystem in India is at an inflection point of evolution, where the Printed Circuit Board (PCB) industry is at the heart of the Ecosystem revolution, a key component of all electronic products, whether that be Smartphones and Smart Appliances, Electric Vehicles, and Medical Devices. The local manufacturing industry of PCBs in India has potential merits to be invested in both by local and foreign players, who want to invest in the high-potential market of the global electronics manufacturing industry, where India has a dream to establish itself as a major world hub of the electronics industry.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-pcb-market?popup=report-enquiry

The Increased Demand led by the Electronics Boom

India has become one of the fastest-growing electronics markets in the world, where it is gradually surpassing the USD 300 billion mark and is estimated to exceed that figure by 2026. This growth is leading to healthy demand for PCBs, with the data suggesting that the growing smartphone consumption, smart TVs, wearable gadgets, and Internet of Things (IoT) devices are skyrocketing in the country. The consumer electronics alone are responsible for close to 40 percent of the total PCB consumption in India. Besides, the rising use of advanced technologies, 5G networks, and cloud computing contributes to the demand for more complex, multilayered PCBs to create possibilities in which the manufacturers can add product lines or revise their processing levels.

Support and Push of Policy and Make in India

The Government of India has given top priority to the electronics and semiconductor value chain under its flagship program of Make in India, as well as the Production-Linked Incentive (PLI) scheme. Presently, India only manufactures its PCBs to the tune of 30-35 percent, with the rest being imported mainly from China and Taiwan. In an attempt to check this reliance and enhance it through domestic production, the government has introduced several incentives such as capital subsidies, tax holidays, as well as cluster development programs. In the recent past, some of the proposals to establish new PCB fabrication plants have been given the go-ahead, which is a strong indication of the intent to localize the policy. The thrust of this policy provides a conducive situation to enable the entry of private players in manufacturing, R&D, and technology upgrade.

Emerging Markets: EVs and automotive electronics

The automotive segment of PCBs is among the most promising spheres to invest in, as India has an electric vehicle (EV) ecosystem growing. With automakers increasing the number of EVs and hybrid cars, the demand for advanced PCBs is soaring, as such PCBs are utilized in battery management systems, charging modules, and infotainment systems. Reports within the industry point out that automotive PCBs may comprise almost 15 percent of the overall PCB demand in India in the next five years. Investors who are specialized in automotive electronics and high-density interconnect (HDI) PCBs are expected to enjoy the growth of this minor niche.

Innovation and Technological Upgradation

The Indian PCB market is now changing dimensions towards multi-layer, flexible, and rigid-flex, complex PCB designs to serve miniaturised and specialised performance devices. This transition requires significant investment in new-generation fabrication, precision test, and cleanroom facilities. Firms that will invest in the modernization of their production lines and integrate Industry 4.0 technologies, including the use of automation, defect detection based on AI, and monitoring facilitated by the use of IoT networks, will experience a competitive advantage. Joint ventures in R&D facilities and alliances with other world technology giants would also speed up innovation in such areas.

Export Potential and Localization of Chain Supply

Other untapped opportunities are the development of an efficient local supply chain of raw materials or intermediate components as copper-clad laminate (CL) and solder mask, etc. Presently, a big percentage of raw material is imported, which includes cost and lead time. Establishment of local ancillary locations would not only decrease the dependence but would also become more price competitive. As India enhances the production capacity of PCBs, it will be able to become a dependable export hub to the international markets and will be particularly beneficial to the Southeast Asia and Middle East markets, which aim to diversify their supply chain outside of their traditional players.

Good Investment climate

Entry of international players, growth of local giants, and increased FDI inflow will be a testament to the faith shown by investors in the PCB market potential in India. Such states as Uttar Pradesh, Tamil Nadu, and Karnataka are becoming clusters of PCB manufacturing businesses, which provide investors strategic positioning advantages like industrial parks, plug-and-play infrastructure, skilled workforce, and closeness to the market. Moreover, the fact that the government places importance on ease of doing business, single window clearances, and digitization of the compliance processes makes the new ventures more attractive.

Click here to view the Report Description & TOC https://univdatos.com/reports/india-pcb-market

India PCB Industry: Investing Ahead

Overall, therefore, the PCB industry in India is at a tipping point, armed with the booming demand and friendly policies, technological innovation, and a defined pathway of self-sufficiency. The active ecosystem can also be utilized by investors focusing on capacity increase, backward integration, R&D partnership, and niche sectors of high value, such as automotive and medical PCBs. Additional value can be unlocked through strategic partnerships, technology transfer, and joint ventures with international players.

With India set to become a global industrial leader in the manufacturing of electronics, today is the best time to make proactive investments in the PCB industry which will not only reap great reward as far as returns are concerned, but will go a long way in necessitating the creation of a resilient and competitive electronics value chain in the future.

Related Report

Chip On Board LED Market: Current Analysis and Forecast (2024-2032)

Functional Safety Market: Current Analysis and Forecast (2022-2028)

Photonic Integrated Circuit Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness