Private Health Insurance Market Trends, Analysis and Forecast to 2032

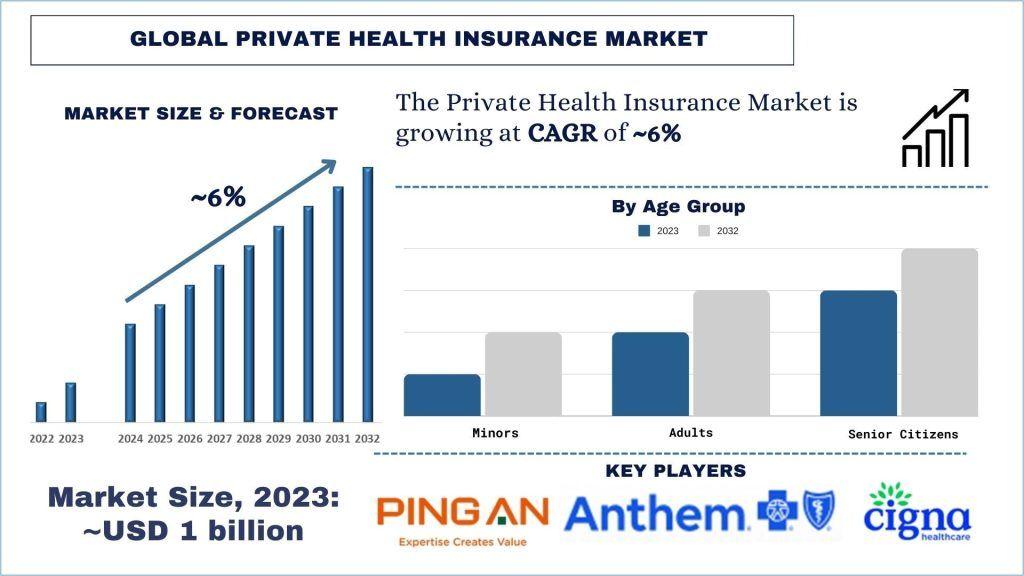

The private health insurance market is undergoing significant transformation, driven by technological advancements, regulatory changes, and evolving consumer preferences. As healthcare costs continue to rise and the demand for quality healthcare services grows, private health insurance providers are innovating to meet these challenges and seize new opportunities. According to the UnivDatos Analysis, growing digital service and government initiatives for insurance coverage in the region will drive the scenario of private health insurance and as per their “Private Health Insurance Market” report, the market was valued at USD ~1 billion in 2023, growing at a CAGR of ~6% during the forecast period from 2024 - 2032 to reach USD billion by 2032.

Surge in Digital Health Technologies

The most prominent trend in the private health insurance market is the surge in digital health technologies. Telemedicine, wearable health devices, and mobile health applications are revolutionizing how healthcare services are delivered and consumed. Insurers are increasingly integrating these technologies into their offerings to enhance patient engagement, improve health outcomes, and reduce costs.

Telemedicine, for instance, has seen exponential growth, especially in the wake of the COVID-19 pandemic. It offers a convenient and efficient way for patients to consult with healthcare providers remotely, reducing the need for in-person visits and minimizing exposure to infectious diseases. Many private health insurers now include telemedicine services as part of their plans, providing policyholders with 24/7 access to medical consultations from the comfort of their homes.

Wearable health devices, such as fitness trackers and smartwatches, are also gaining popularity. These devices enable continuous monitoring of vital signs and physical activity, providing valuable data that insurers can use to offer personalized health plans and proactive wellness programs. By leveraging data from wearables, insurers can incentivize healthy behaviors, such as regular exercise and proper nutrition, ultimately lowering healthcare costs and improving policyholders' overall health.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/private-health-insurance-market?popup=report-enquiry

Regulatory Changes and Government Initiatives

Regulatory changes and government initiatives are playing a crucial role in shaping the private health insurance market. In many countries, governments are implementing reforms aimed at increasing access to healthcare, improving the quality of services, and controlling costs. These reforms often involve changes to the regulatory framework governing private health insurance, impacting how insurers operate and design their products.

In the United States, for example, the Affordable Care Act (ACA) has had a profound impact on the private health insurance market. The ACA introduced several provisions aimed at expanding coverage, such as the establishment of health insurance marketplaces and the requirement for insurers to cover essential health benefits. Recent discussions around healthcare reform continue to influence the market, with potential changes to the ACA and other regulations being closely monitored by insurers.

In emerging economies, governments are also taking steps to promote private health insurance. For instance, in India, the government has launched initiatives like the Ayushman Bharat scheme, which aims to provide health coverage to millions of low-income families. Such initiatives are encouraging the growth of the private health insurance market by increasing awareness and demand for insurance products.

Advancements

Technological advancements have significantly influenced the private health insurance market in North America.

· In January 2024, HCSC entered into a binding contract with The Cigna Group to purchase its Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. This acquisition will bring significant advantages to HCSC's existing and prospective members, as it will strengthen the company's capabilities and expand its presence, especially in the expanding Medicare sector.

· In January 2024, Elevance Health announced its plans to acquire Paragon Healthcare Inc., a prominent company that provides essential infusible and injectable therapies that enhance and sustain lives. This strategic acquisition aimed to deepen Elevance Health's capabilities in offering affordable and convenient access to specialty medications for individuals living with chronic and complex illnesses

The Rise of Insurtech

Insurtech, the use of technology to innovate and improve the insurance industry, is another significant trend in the private health insurance market. Startups and established insurers alike are leveraging insurtech solutions to streamline operations, enhance customer experience, and develop new products.

Artificial intelligence (AI) and machine learning are being used to analyze vast amounts of data, enabling insurers to identify trends, predict risks, and personalize offerings. AI-powered chatbots and virtual assistants are improving customer service by providing instant support and guidance to policyholders.

Blockchain technology is also gaining traction in the insurance industry. It offers the potential to improve transparency, security, and efficiency in processes such as claims management and policy administration. By using blockchain, insurers can reduce fraud, streamline transactions, and enhance trust between parties.

Conclusion

The private health insurance market is in a state of rapid evolution, driven by technological advancements, regulatory changes, and shifting consumer preferences. The integration of digital health technologies, the personalization of insurance plans, and the rise of insurtech are transforming the way health insurance is delivered and consumed. At the same time, global events and government initiatives are reshaping the market landscape, creating new challenges and opportunities for insurers.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- משחקים

- Gardening

- Health

- בית

- Literature

- Music

- Networking

- לא משנה

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness