Lubricants Market Insights, Industrial Use Trends and Forecast Projection (2021-2027) |UnivDatos

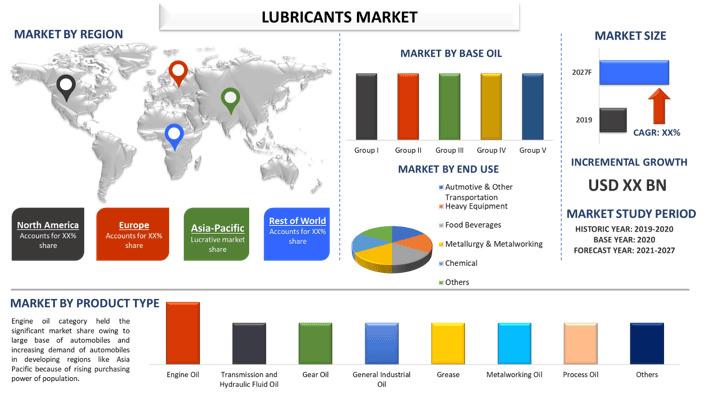

According to UnivDatos, the lubricants market was valued at approximately US$ 135 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 2% during the forecast period 2021–2027.

Access sample report (including graphs, charts, and figures) https://univdatos.com/reports/lubricants-market?popup=report-enquiry

The global lubricants market is on a growth trajectory, driven by the increasing mechanization of industries, expanding automobile demand, and the rising purchasing power of consumers across the globe. The report highlights how advancements in base oil technology, post-pandemic recovery in industrial activities, and a surge in automotive sales are reshaping the industry. Asia Pacific emerges as a dominant force, backed by booming infrastructure and growing automotive sectors in key economies such as China, India, and ASEAN nations.

Lubricants: A Backbone of Industrial Efficiency

Lubricants are integral to the smooth operation of machinery across multiple sectors, providing essential benefits such as friction reduction, heat dissipation, and wear prevention. These performance-enhancing properties directly influence equipment longevity and operational efficiency, making lubricants a crucial input for manufacturing and transportation industries.

The refinement of crude oil-via methods like solvent refining, hydrotreating, or hydrogenation—produces mineral base oils. In contrast, synthetic base oils are manufactured using chemical processes, often without crude oil refinement. These base oils are subsequently blended with specialized additives to create commercial-grade lubricants suitable for various applications.

Impact of COVID-19 on Market Dynamics

Despite its robust fundamentals, the lubricants market experienced a temporary downturn in 2020 due to the COVID-19 pandemic. The global oil refinery throughput dropped to 75,512 thousand barrels per day, down from 82,954 thousand barrels per day in 2019, reflecting reduced demand for refined petroleum products, including lubricants. Additionally, a significant 16% decline in global automobile sales and widespread halts in industrial operations further suppressed lubricant consumption.

However, the post-pandemic recovery has been strong. In the first half of 2021, vehicle sales rebounded to 44.4 million units, up from 34.3 million units during the same period in 2020, suggesting that the market is back on a growth path, led by renewed industrial activity and consumer spending.

Base Oil Trends: Group II Leading the Pack

The lubricants market is segmented based on base oil types into Group I, Group II, Group III, Group IV, and Group V. Among these, Group II base oil held a commanding share in 2020 and is projected to maintain its leadership during the forecast period. This dominance stems from its superior efficiency and lower emissions compared to Group I oils.

Industries are also finding it increasingly viable to transition from Group I to Group II oils by making modest changes in their processing techniques and sourcing strategies. As a result, Group II lubricants are witnessing increased penetration across industrial and automotive applications, marking a significant shift toward higher-performance and environmentally compliant formulations.

Product Categories: Engine Oils Drive the Market

When categorized by product type, the market spans engine oil, general industrial oil, metalworking oil, grease, transmission and hydraulic fluid oil, gear oil, process oil, and others. Of these, engine oil represents the largest segment, propelled by the expanding base of automobile users, especially in developing economies.

Emerging markets in the Asia Pacific region are witnessing a surge in vehicle ownership, thanks to rising disposable incomes and expanding middle-class populations. Additionally, stringent automotive emission regulations worldwide are prompting increased lubricant usage, as these products play a critical role in reducing equipment wear and emissions.

End-Use Analysis: Automotive & Transportation at the Forefront

From an end-use perspective, the market is divided into automotive & other transportation, heavy equipment, food & beverages, metallurgy & metalworking, chemical, and others. The automotive and transportation segment leads the market by a significant margin. The growth is largely attributed to:

- Increased global vehicle sales

- Rising per capita income

- Expanding mobility services sector

As vehicle sales continue to climb, especially in the wake of electric and hybrid vehicle adoption, the demand for high-performance lubricants is set to grow in tandem. Furthermore, the broader transportation sector—including aviation, marine, and rail—is driving additional lubricant consumption globally.

Regional Outlook: Asia Pacific as the Growth Engine

In terms of geography, the global lubricants market is segmented into North America, Europe, Asia Pacific, and Rest of the World. Among these, Asia Pacific holds the dominant share and is anticipated to record the highest growth rate over the forecast period.

This regional leadership can be attributed to several factors:

- High automobile manufacturing and sales in China, India, and Southeast Asia

- Rapid industrialization and infrastructure development

- Government support for manufacturing and exports

Additionally, the region's increasing crude oil refining capacities and the shift toward more efficient lubricants contribute to its growing influence in the global lubricants landscape.

Competitive Landscape

The lubricants market is highly consolidated, with a mix of global energy giants and regional players competing for market share. Key players include:

- Chevron Corporation

- British Petroleum Plc.

- Exxon Mobil Corporation

- Royal Dutch Shell Plc.

- TotalEnergies SE

- PetroChina Company Limited

- China Petroleum & Chemical Corporation

- Idemitsu Kōsan kabushiki geisha

- JX Nippon Oil & Gas Exploration Corporation

- Fuchs Petrolub SE

These companies are actively investing in R&D, exploring advanced additive technologies, and expanding their product portfolios to cater to the evolving needs of industries and end-users.

Click here to view the Report Description & TOC https://univdatos.com/reports/lubricants-market

Conclusion

The global lubricants market is well-positioned for steady growth, supported by technological advancements, increased industrial output, and higher automobile sales-especially in fast-developing economies. The shift toward high-efficiency lubricants like Group II base oils, combined with a renewed focus on sustainability and emission control, is further shaping market dynamics.

Asia Pacific is expected to continue its dominance, driven by a robust industrial base and rising consumer demand. With high purchasing power and increasing mobility needs, the region presents unparalleled growth opportunities for lubricant manufacturers and suppliers in the years ahead.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness