Mexico Furniture Market Size, Demand, Growth & Industry Outlook 2025-2033

Market Overview 2025-2033

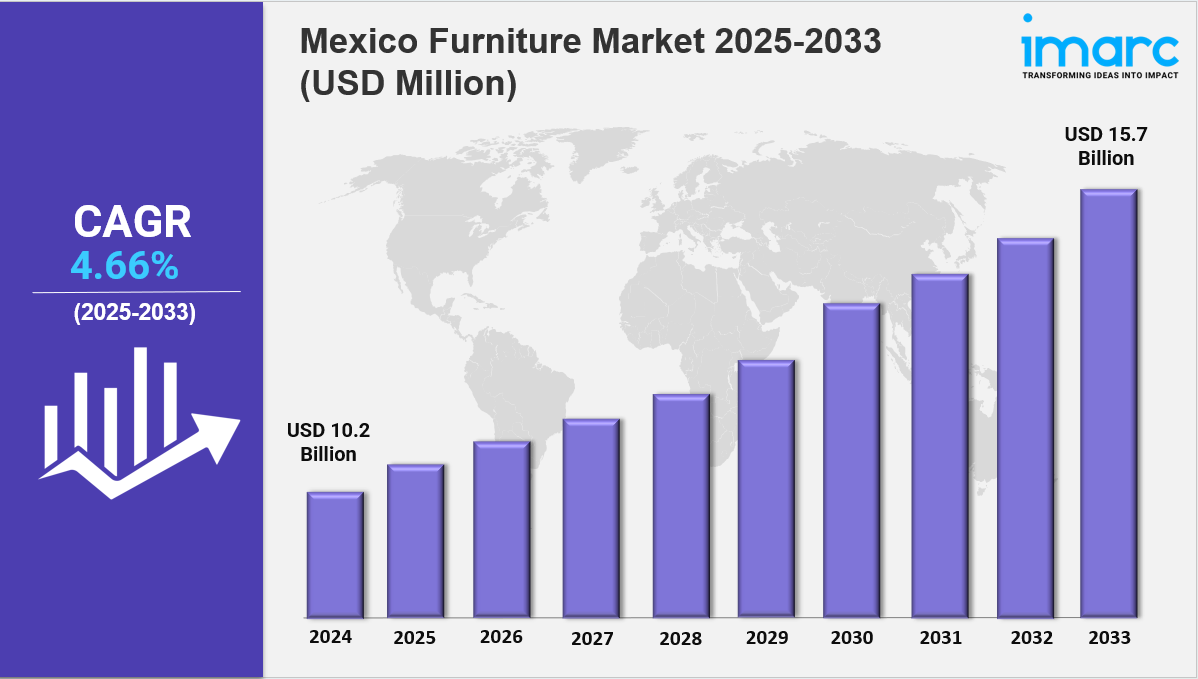

Mexico furniture market size reached USD 10.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. The market is expanding due to rising urbanization, increasing disposable incomes, and growing demand for space-efficient, modern ***gns. Growth is driven by smart furniture innovations, e-commerce expansion, and sustainable materials, making the industry more dynamic, tech-integrated, and globally competitive.

Key Market Highlights:

✔️ Rising urbanization and home ownership fueling demand for modern furniture

✔️ Growth in e-commerce and online furniture retail platforms increasing market reach

✔️ Expanding middle-class population boosting preference for affordable, stylish home furnishings

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-furniture-market/requestsample

Mexico Furniture Market Trends and Drivers:

The Mexico Furniture Market is undergoing dynamic transformation, driven by rapid urbanization, evolving consumer lifestyles, and shifting ***gn preferences. With nearly 80% of the population residing in urban areas, the demand for compact, multifunctional furniture has surged. Space-saving solutions like modular storage units, fold-out sofas, and wall-mounted desks are becoming essential components of modern Mexican homes. Local companies such as Muebles Dico and Flexi are responding to this trend with affordable furniture tailored to small-space living. The rise in remote work has further fueled Mexico Furniture Market Demand, particularly for smart, budget-conscious home office furniture.

Affordability remains a key purchasing driver, with over 60% of urban consumers citing price as their top consideration, according to INEGI. However, sustainability is an emerging priority, especially among younger buyers. As Mexico Furniture Market Trends evolve, furniture made from recycled, reclaimed, or ethically sourced materials is gaining traction, reshaping both consumer behavior and production strategies.

Digital transformation is accelerating across the Mexico Furniture Market. In 2024, e-commerce grew by 34%, thanks to platforms like Gaia and Muebles Click, which are enhancing the online shopping experience through virtual showrooms and 3D room planners. Despite digital growth, traditional retailers such as Liverpool are innovating with hybrid models—integrating in-store cafés and VR experiences to draw customers and elevate the physical shopping journey.

New purchasing models are contributing to broader Mexico Furniture Market Demand. Rent-to-own and leasing options are becoming more popular, especially among young professionals seeking flexible, low-risk furnishing solutions. Mexican artisans are also reaching larger audiences, particularly in the U.S. Hispanic market. Handmade, culturally inspired furniture generated over $220 million in cross-border sales in 2024, supported by platforms like Mercado Libre.

Sustainability is increasingly influencing Mexico Furniture Market Trends. SEMARNAT regulations now require major manufacturers to use at least 30% recycled materials. In response, producers are experimenting with innovative inputs like agave-fiber boards and FSC-certified wood. Premium brands such as Taller Lu’um are leading the charge by combining traditional craftsmanship with sustainable practices, creating products that emphasize natural textures and reclaimed materials.

On the manufacturing side, localized supply chains are becoming more prominent to reduce costs and enhance resilience. Foam production has returned to hubs like Nuevo León, while Guanajuato factories are focusing on flat-pack ***gns to cut logistics expenses. There’s also a push to integrate modern functionality—USB ports, concealed storage, and wireless charging—into traditional furniture styles, reflecting new Mexico Furniture Market Trends.

Domestic production is expanding, partly due to new tariffs on imported furniture, which led to an 18% increase in local output in 2024. However, exports to the U.S. declined by 9%, as Mexico faces rising competition from other nearshoring markets. Informal workshops still contribute significantly to the sector but raise ongoing concerns regarding quality control and product standardization.

Generational differences are also shaping the Mexico Furniture Market. Younger consumers are embracing rental platforms like RentaMueble, while older buyers prioritize ergonomic and comfort-driven options, such as recliners and zero-gravity chairs. Creative collaborations are growing—Vitropol’s modern glass tables featuring hand-painted Talavera tiles from Puebla exemplify a successful fusion of innovation and heritage.

In summary, the Mexico Furniture Market Outlook remains positive. As sustainability, technology, and evolving lifestyle needs continue to influence production and ***gn, the market is well-positioned for sustained Mexico Furniture Market Growth. By balancing tradition with modern convenience and adapting to changing consumer demands, Mexico's furniture sector is becoming increasingly competitive and resilient on both domestic and global stages.

Mexico Furniture Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Material:

-

Metal

-

Wood

-

Plastic

-

Glass

-

Others

Breakup by Distribution Channel:

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Stores

-

Others

Breakup by End Use:

-

Residential

-

Commercial

Breakup by Region:

-

Northern Mexico

-

Central Mexico

-

Southern Mexico

-

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness