The Future of Credit Cards in Canada: Digital Payments, AI, and BNPL Trends

Introduction: Why the Canada Credit Cards Market Matters

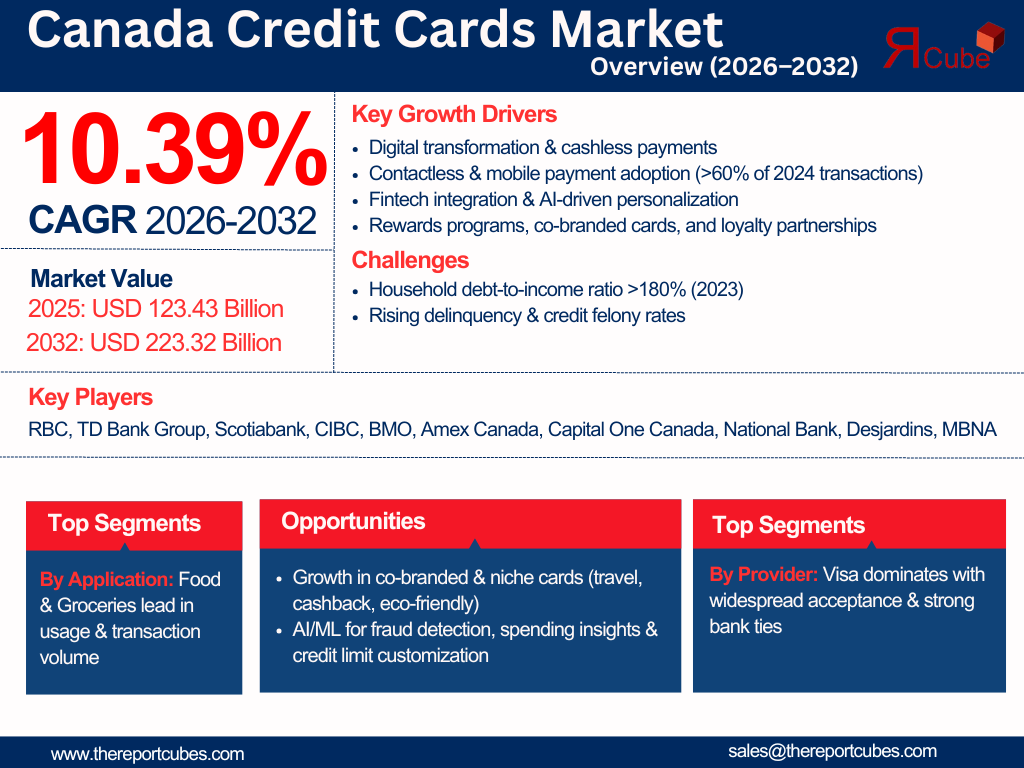

The Canada ***s market Size is a dynamic and rapidly evolving sector that plays a crucial role in the country’s financial ecosystem. With digital payments becoming the norm and consumer spending habits shifting, ***s remain a dominant payment method. According to Report Cube, the Canada Credit Cards Market is anticipated to register a CAGR of around 10.39% during the forecast period (2026-2032). The market, valued at nearly USD 123.43 billion in 2025, is expected to reach USD 223.32 billion by 2032.

This growth reflects changing consumer behaviors, technological advancements, and the increasing adoption of cashless transactions. For businesses, financial institutions, and investors, understanding the key drivers, challenges, and future trends in this market is essential for strategic decision-making.

Key Drivers of Growth in the Canada Credit Cards Market

Several factors are fueling the expansion of Canada’s *** market:

1. Rising Consumer Spending & Economic Recovery

As Canada’s economy rebounds post-pandemic, consumer spending has surged. ***s remain a preferred payment method due to their convenience, rewards, and purchase protection benefits.

2. Digital Payment Adoption

The shift toward contactless payments and mobile wallets (like Apple Pay and Google Pay) has accelerated *** usage. Banks and fintech companies are introducing tap-to-pay and virtual ***s, enhancing user experience.

3. Attractive Rewards & Loyalty Programs

*** issuers are competing aggressively by offering cashback, travel rewards, and premium perks. These incentives encourage higher card usage and customer retention.

4. Fintech Innovation & BNPL Integration

Fintech companies are reshaping the market with Buy Now, Pay Later (BNPL) options linked to ***s. This hybrid model provides flexibility, attracting younger consumers.

5. Increased Credit Card Penetration

Despite Canada’s high *** ownership, there’s still room for growth among underbanked populations, including newcomers and young adults. Financial institutions are targeting these segments with tailored products.

Challenges & Restraints in the Market

While the market is expanding, certain obstacles could slow growth:

1. High Household Debt Levels

Canada has one of the highest household debt-to-income ratios globally. Rising interest rates and inflation may lead to stricter lending standards, limiting *** issuance.

2. Regulatory Scrutiny & Compliance Costs

The Canadian government has introduced stricter regulations on *** fees, interest rates, and data security. Compliance with these rules increases operational costs for issuers.

3. Fraud & Cybersecurity Risks

As digital transactions grow, so do cyber threats. *** fraud remains a concern, pushing companies to invest in advanced security measures like AI-driven fraud detection.

4. Competition from Alternative Payment Methods

Digital wallets, cryptocurrencies, and peer-to-peer payment platforms (like PayPal) are gaining traction, potentially reducing reliance on traditional ***s.

Future Trends & Opportunities

The Canada ***s market is poised for transformation, with several emerging trends shaping its future:

1. AI & Personalization

Banks are leveraging AI and machine learning to offer hyper-personalized *** recommendations, spending insights, and fraud prevention.

2. Sustainability-Focused Credit Cards

Eco-conscious consumers are driving demand for green ***s that offer carbon offset rewards or donations to environmental causes.

3. Expansion of Embedded Finance

***s are being integrated into e-commerce platforms, apps, and even social media, enabling seamless in-app purchases.

4. Open Banking & Enhanced Data Sharing

Canada’s move toward open banking will allow fintech firms to offer better credit products by accessing consumer financial data (with permission).

5. Focus on Financial Inclusion

New credit-building cards and low-interest options are being introduced to serve students, immigrants, and thin-file customers, expanding market reach.

Conclusion: Why Stakeholders Should Watch This Market

The Canada ***s market is on a strong growth trajectory, driven by digital innovation, consumer demand for rewards, and economic recovery. However, challenges like high household debt, regulatory pressures, and fraud risks require careful navigation.

For banks, fintech firms, and investors, this market presents lucrative opportunities—especially in AI-driven personalization, sustainable finance, and embedded payments. Consumers, meanwhile, will benefit from more choices, better rewards, and enhanced security.

As the market evolves toward USD 223.32 billion by 2032, staying ahead of trends and adapting to regulatory changes will be key to long-term success. Whether you're a financial institution, a business, or a consumer, understanding these dynamics will help you make smarter financial decisions in Canada’s fast-moving *** landscape.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness