Sponsored

Micro‑Dose X‑Ray Systems Align with ALARA Standards

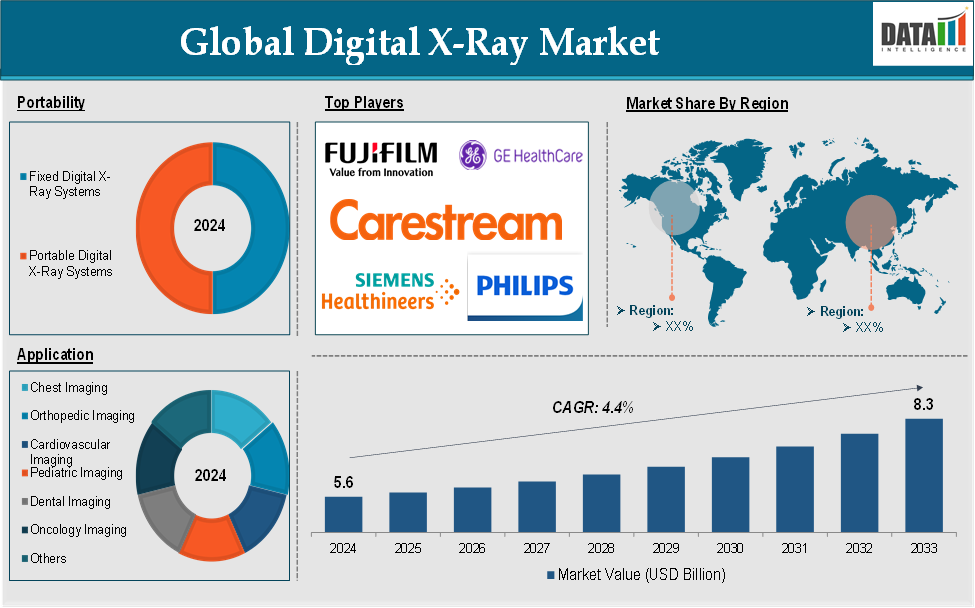

The digital X‑ray market is poised for significant growth, rising from USD 5.4 billion in 2024 to USD 6.6 billion by 2029, at a 4.0% CAGR, driven by portable systems, smart AI-enabled devices, and rising demand in North America and Asia-Pacific.

Digital X‑ray market

Request a sample copy of the research report: https://www.datamintelligence.com/download-sample/digital-x-ray-market

📈 Market Overview & Growth Drivers

-

Market Size & Forecast

The global digital X‑ray market stood at USD 5.4 B in 2024, forecast to reach USD 6.6 B by 2029 (4.0% CAGR). -

Portable System Surge

Portable and mobile X‑ray systems are rapidly gaining traction, offering bedside diagnostics for ICU patients and remote settings, significantly reducing infection risk. -

AI & Workflow Innovation

Integration of AI and machine learning—such as Siemens, Canon, and EOS-edge micro‑dose imaging—is improving image clarity, reducing radiation exposure, and automating triage. -

Chronic Disease & Elderly Populations

Increased prevalence of cancer, cardiovascular, and respiratory diseases globally is propelling diagnostic imaging demand.

🇺🇸 U.S. Market Insights

-

Dominance in North America

The U.S. leads the digital X‑ray market, driven by adoption of direct radiography (DDR)—offering faster workflows and seamless integration in hospital systems. -

R&D-backed Device Launches

Companies like Carestream (DRX‑Compass) and Samsung (GM85 Fit) have launched AI-enabled, mid-tier digital radiography systems with FDA approvals. -

Teleradiology & Edge AI

Growing teleradiology adoption is supported by cloud and edge AI, enabling remote consultations and faster image processing.

🇯🇵 Japan & Asia‑Pacific Overview

-

Japan Market Growth

Japan’s digital X‑ray market reached USD 555.7 M in 2024, projected to hit USD 968.9 M by 2030 (CAGR 9.54%). -

APAC Expansion

Asia-Pacific generated USD 950.4 M in 2022, expected to grow at 4.5% CAGR by 2030, with China leading regional gains. -

Portable & AI Trends in Japan

Fixed systems still dominate in Japan, but portable units—wireless, high-resolution, AI-driven—are the fastest-growing segment. -

Government & Aging Pressure

With over 30% of citizens aged 60+, government *** in digital radiography and AI-enabled imaging software supports early diagnosis and efficiency.

🚀 Market Opportunities

-

More Portable Deployments

Investing in mobile systems can expand access in emergency, remote, and home-care settings. -

AI & Edge Intelligence

Devices equipped with edge AI for immediate triage and cloud ***ytics offer high-value differentiation. -

Teleradiology Integration

With a 15% annual rise in imaging procedures, global teleradiology services are in demand. -

Micro‑dose Radiation

Low-dose systems like EOS-edge align with ALARA standards and open avenues in pediatric and orthopedic imaging. -

Emerging APAC Growth

Countries like India and China offer growth by deploying affordable, durable digital X‑ray systems in expanding healthcare networks.

⚠️ Key Challenges

-

High Device Costs

Initial technology ***s (detector plates: USD 10K–100K) and maintenance costs can stall adoption. -

Access Gaps

Smaller clinics, especially in rural regions, may lack infrastructure and skilled personnel for advanced systems. -

Regulatory Compliance

FDA clearance, radiation safety, and health data protection standards vary by region.

👥 User Perspective

“Portable X‑ray devices reduce wait times and allow bedside scans in critical care without moving patients,” notes a Japanese market report.

On cost, “digital detectors cost in the 10s of thousands” but enable powerful clinical workflows.

Request a Quotation: https://www.datamintelligence.com/buy-now-page?report=digital-x-ray-market

🎯 Strategic Outlook

-

Manufacturers: Focus on next‑gen portable, AI-equipped, micro-dose systems for remote and emergency use.

-

Clinics & Hospitals: Invest in teleradiology platforms and edge-enabled imaging for improved patient flow.

-

Regulators: Harmonize approval processes, encourage low-dose standards (ALARA), and support rural deployment.

-

Investors: Back solutions hitting sweet spots in AI, mobility, and APAC convergence.