Natural Rubber Price Trend: Market Insights and Analysis

Natural rubber is an essential commodity with extensive applications in industries such as automotive, healthcare, construction, and consumer goods. Derived from the latex sap of rubber trees, it is widely used in the production of tyres, gloves, adhesives, and industrial goods due to its high elasticity, resilience, and abrasion resistance. Understanding the Natural Rubber Price Trend is crucial for manufacturers, suppliers, and procurement professionals to make informed decisions and manage price fluctuations. This article explores the latest price trends, market dynamics, historical data, forecasts, and regional insights.

Latest Price Trends

The natural rubber market has experienced price volatility due to several factors, including fluctuating global demand, supply chain disruptions, and environmental challenges. Recent trends in natural rubber pricing are influenced by the following:

-

Increased Demand from the Automotive Sector:

The automotive industry, which accounts for over 70% of global natural rubber consumption (primarily for tyres), has seen increased production, particularly in electric vehicles (EVs). This has led to heightened demand, contributing to rising rubber prices. -

Weather and Climate Conditions:

Natural rubber production is heavily dependent on weather conditions in key producing countries such as Thailand, Indonesia, and Malaysia. Prolonged rainy seasons or droughts can reduce latex yields, impacting supply and pushing up prices. -

Supply Chain Bottlenecks:

Disruptions in transportation, labour shortages, and high freight costs have led to supply delays and increased procurement costs for natural rubber, further affecting the price trend. -

Global Economic Recovery:

The recovery of global manufacturing and construction sectors post-pandemic has boosted demand for natural rubber, particularly in emerging markets, adding upward pressure to prices. -

Regulatory Changes and Export Restrictions:

Export policies and government regulations in rubber-producing nations, aimed at stabilising domestic prices or addressing environmental concerns, can impact the global supply and pricing of natural rubber.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/natural-rubber-price-trends/pricerequest

Market Analysis

The natural rubber market is shaped by supply-demand dynamics, geopolitical factors, and industry-specific trends. Below are the key drivers influencing the market:

Demand Drivers

-

Automotive and Tyre Industry:

The automotive sector is the largest consumer of natural rubber, using it for tyres, seals, hoses, and belts. The growing production of fuel-efficient and electric vehicles (EVs) has increased the demand for high-performance rubber compounds. -

Medical and Healthcare:

The healthcare industry relies on natural rubber for the production of medical gloves, catheters, and other equipment. The COVID-19 pandemic led to a surge in demand for disposable gloves, further increasing rubber consumption in the healthcare sector. -

Industrial Applications:

Natural rubber is used in the manufacturing of conveyor belts, shock absorbers, and vibration control systems, making it a critical input for industrial machinery and equipment. -

Consumer Goods:

The demand for natural rubber in consumer products such as footwear, adhesives, and sports equipment remains strong, driven by population growth and urbanisation.

Supply Constraints

-

Production Concentration:

Over 80% of the world's natural rubber is produced in Southeast Asia, making the global market highly dependent on the output from a few key countries. Any disruptions in these regions can have significant impacts on global supply. -

Labour and Plantation Issues:

Labour shortages, ageing rubber plantations, and reduced replanting efforts have contributed to lower yields in key producing regions. -

Climate Change:

Unpredictable weather patterns, including excessive rainfall or prolonged droughts, can affect latex tapping cycles and overall production. -

Pests and Diseases:

Diseases such as leaf fall disease have affected rubber plantations, particularly in Indonesia and Sri Lanka, leading to supply reductions.

Historical Data and Forecasts

Historical Price Trends

Natural rubber prices have exhibited cyclical patterns influenced by economic conditions, industrial demand, and supply constraints. Key historical trends include:

- 2011-2013: Natural rubber prices surged to record highs due to strong demand from China and supply constraints in Southeast Asia.

- 2014-2017: Prices stabilised as new rubber plantations reached maturity, leading to increased global supply.

- 2018-2020: Prices declined due to trade tensions and reduced demand from the automotive sector.

- 2021-Present: Prices rebounded as global economies recovered from the pandemic, with heightened demand for tyres and healthcare products contributing to price increases.

Forecasts

Market forecasts suggest that natural rubber prices will remain volatile in the short term due to ongoing weather-related supply disruptions and energy cost fluctuations. However, long-term price stability may be achieved with advancements in sustainable rubber farming practices and increased investments in replanting efforts. The global shift towards electric vehicles and the rising focus on sustainable materials are expected to sustain demand for natural rubber over the next decade.

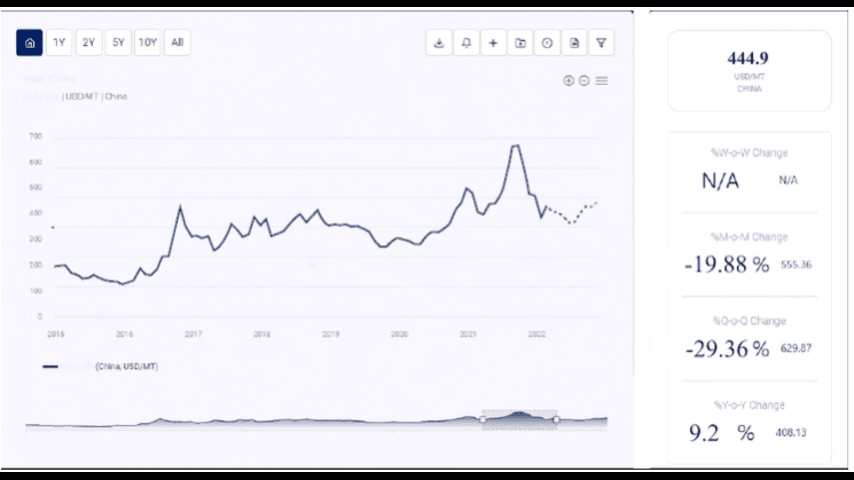

Database Insights and Chart Representation

Tracking the Natural Rubber Price Trend requires access to reliable databases and market intelligence tools that provide real-time data, historical price movements, and market forecasts.

Key Insights from Price Charts

- Regional Price Differences: Prices are typically lower in Asia-Pacific, the primary production hub, while import-dependent regions such as Europe and North America face higher prices due to transportation and tariff costs.

- Seasonal Patterns: Natural rubber prices often increase during the rainy season, when latex tapping becomes difficult and yields decline.

- Demand Spikes: Global events, such as economic recoveries or pandemics, can lead to significant demand surges and corresponding price hikes.

By leveraging data visualisations and historical trends, businesses can develop effective procurement strategies and anticipate price fluctuations.

Market Insights

Sustainability Initiatives

The natural rubber industry is increasingly focused on sustainable practices, including responsible plantation management, reforestation, and zero-deforestation policies. Large manufacturers and buyers are investing in sustainable supply chains to meet consumer demands for eco-friendly products, which may influence long-term pricing.

Technological Advancements

Innovations in synthetic rubber blends and bio-based alternatives are being explored to reduce dependence on natural rubber. However, natural rubber's unique properties, such as resilience and flexibility, remain unmatched, ensuring its continued demand in key industries.

Electric Vehicle (EV) Revolution

The rise of electric vehicles has boosted demand for high-performance tyres that require reinforced rubber compounds to handle higher weights and torque. This trend is expected to sustain natural rubber demand over the coming years.

Regional Insights and Analysis

Asia-Pacific

Asia-Pacific accounts for over 85% of global natural rubber production, with Thailand, Indonesia, and Vietnam being the leading producers. The region benefits from favourable climatic conditions for rubber plantations, but environmental regulations and climate-related disruptions have impacted production levels in recent years.

North America

The North American market relies on natural rubber imports to meet its industrial demand, particularly for automotive and medical applications. The region's dependence on imports makes it vulnerable to price fluctuations caused by global supply chain disruptions.

Europe

Europe's natural rubber market is driven by demand from the automotive and manufacturing sectors. Strict environmental regulations have led to increased investments in sustainable sourcing and synthetic rubber alternatives, although the reliance on natural rubber for specific applications remains significant.

Africa and Latin America

Countries in Africa and Latin America, such as Côte d'Ivoire, Nigeria, and Brazil, are emerging as key players in the global rubber market due to investments in rubber plantations and processing facilities. However, these regions face challenges related to infrastructure and export logistics.

Role of Procurement Resource

Platforms like Procurement Resource provide critical market intelligence for businesses navigating the natural rubber market. Key features include:

- Real-Time Price Monitoring: Stay updated on the latest price movements and forecasts.

- Market Analysis: Access comprehensive data on production levels, regional trends, and demand forecasts.

- Cost Optimisation: Identify the most cost-effective sourcing options and mitigate risks associated with price volatility.

By leveraging Procurement Resource, businesses can make data-driven decisions, optimise procurement strategies, and ensure a steady supply of natural rubber.

The Natural Rubber Price Trend is influenced by a combination of supply constraints, rising global demand, and environmental challenges. By understanding these factors and leveraging actionable insights, stakeholders can navigate market complexities and secure a competitive edge in the global rubber market.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness