U.S. Feminine Hygiene Products Market Size, Growth, Latest Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “U.S. Feminine Hygiene Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

U.S. Feminine Hygiene Products Market Overview

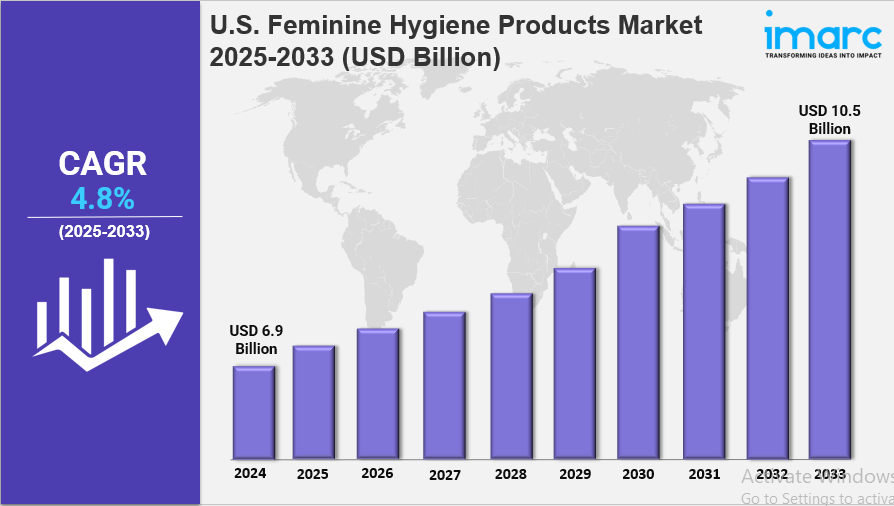

The U.S. feminine hygiene products market was valued at USD 6.9 Billion in 2024 and is projected to reach USD 10.5 Billion by 2033. With an expected CAGR of 4.8% from 2025 to 2033, the market growth is fueled by rising demand for safe, innovative, and eco-friendly hygiene products among women. Increasing availability in pharmacies and a shift towards organic and reusable items like menstrual cups also contribute to this growth.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

U.S. Feminine Hygiene Products Market Key Takeaways

-

Current Market Size: USD 6.9 Billion in 2024

-

CAGR: 4.8%

-

Forecast Period: 2025-2033

-

Rising demand for convenient sanitary products is driven by more women entering the workforce, seeking comfort and ease of use during long hours.

-

Product innovations include organic tampons, reusable menstrual cups, and biodegradable pads to meet sustainability needs.

-

Expansion of pharmacy stores enhances product accessibility through long hours and click-and-collect services.

-

Sanitary napkins remain popular due to ease of use and simplicity, especially among beginners and younger users.

-

Increasing menstrual health awareness and efforts to reduce stigma are driving adoption of hygiene products.

Sample Request Link: https://www.imarcgroup.com/united-states-feminine-hygiene-products-market/requestsample

U.S. Feminine Hygiene Products Market Growth Factors

U.S. Feminine Hygiene Products Market growth is being driven by increasing consumer demand for safe, comfortable, and high-quality hygiene solutions that promote better personal care and well-being. As more women join the workforce, there's a noticeable shift towards convenient products like menstrual pads, tampons, and panty liners that provide both discretion and comfort during those long hours at work. Innovations in compact and travel-friendly packaging are also helping brands cater to busy working women. Plus, sustainable choices like menstrual cups, which are durable and cost-effective, are becoming increasingly popular.

Product innovation plays a key role in this growth, with brands focusing on organic tampons, reusable menstrual cups, and biodegradable pads to tackle environmental issues. Technological advancements are improving product features such as absorbency, leak prevention, and compact designs, making them more suitable for hectic lifestyles. For instance, researchers at Purdue University have developed biodegradable superabsorbent materials from hemp, offering eco-friendly alternatives to traditional petroleum-based products. Additionally, odor-neutralizing and hypoallergenic options are enhancing user comfort.

The expansion of pharmacy store networks is making these products more accessible in both urban and rural areas, providing a wide range of choices from conventional to eco-friendly options. Features like click-and-collect and same-day delivery from Amazon Pharmacy, which is set to expand by 2025, are making it easier for consumers to get their hands on feminine hygiene products quickly and reliably. Plus, having pharmacists available to offer guidance helps women make informed decisions about their menstrual health. All these factors are contributing to market growth and boosting consumer confidence in the quality and availability of these products.

To get more information on this market, Request Sample

U.S. Feminine Hygiene Products Market Segmentation

Breakup by Product Type:

-

Sanitary Pads: Hold a considerable market share due to their high absorbency and suitability for various menstrual flows; widely accessible in urban and rural areas.

-

Panty Liners: Popular for daily use or lighter flows, offering comfort and hygiene; ultra-thin and breathable options increase adoption.

-

Tampons: Favored by active women and athletes due to compact size and comfort; advanced designs support sustainability preferences.

-

Spray and Internal Cleaners: Specialized products for odor control and cleanliness with gentle, pH-balanced formulations enhancing demand.

-

Others

Breakup by Distribution Channel:

-

Supermarkets and Hypermarkets: Leading segment offering diverse products with competitive pricing and convenience.

-

Specialty Stores: Provide eco-friendly and premium products catering to niche customers seeking customized solutions.

-

Beauty Stores and Pharmacies: Appeal to buyers seeking intimate hygiene with pharmacist recommendations and premium options.

-

Online Stores: Growing rapidly due to convenience, wider product ranges, subscription models, and competitive pricing.

-

Others

Regional Insights

The West region leads in the adoption of innovative and sustainable feminine hygiene products, driven by high environmental consciousness in states like California. This tech-savvy population also influences the growing online sales and subscription service usage. The Northeast region shows strong demand due to urban density and access to premium products. The Midwest balances demand between cost-effective products in rural areas and premium products in urban centers, supported by awareness campaigns. The South represents a significant market share with expanding retail networks facilitating product accessibility.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=19176&flag=C

Recent Developments & News

In July 2024, Virginia Tech researchers developed an eco-friendly menstrual pad that turns blood into gel for enhanced absorption, improved hygiene, and reduced risk of toxic shock syndrome. In April 2024, Pinkie Pads launched a tween-focused product line in Walmart stores catering to younger girls with discreet feminine hygiene solutions. In November 2024, The Honey Pot introduced Witch Hazel Intimate Wash & Wipes offering gentle care for intimate hygiene with natural ingredients like witch hazel.

Key Players

-

The Honey Pot

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness